Olivers Insights

The RBA leaves rates on hold – have we finally reached the top?

At its December meeting the RBA left the cash rate on hold at 4.35%. This was in line with our own view & that of most economists along with money market expectations. It followed a 13th hike at its November meeting which meant a total of 425 basis points over 19 months since May last year, which has been the

Read MoreIntroduction

At its December meeting the RBA left the cash rate on hold at 4.35%. This was in line with our own view & that of most economists along with money market expectations. It followed a 13th hike at its November meeting which meant a total of 425 basis points over 19 months since May last year, which has been the biggest interest rate hiking cycle since the late 1980s.

RBA rate hiking cycles since the late 1980s

Source: RBA, AMP

This took the cash rate to levels last seen in 2011 and mortgage rates to levels last seen in 2008.

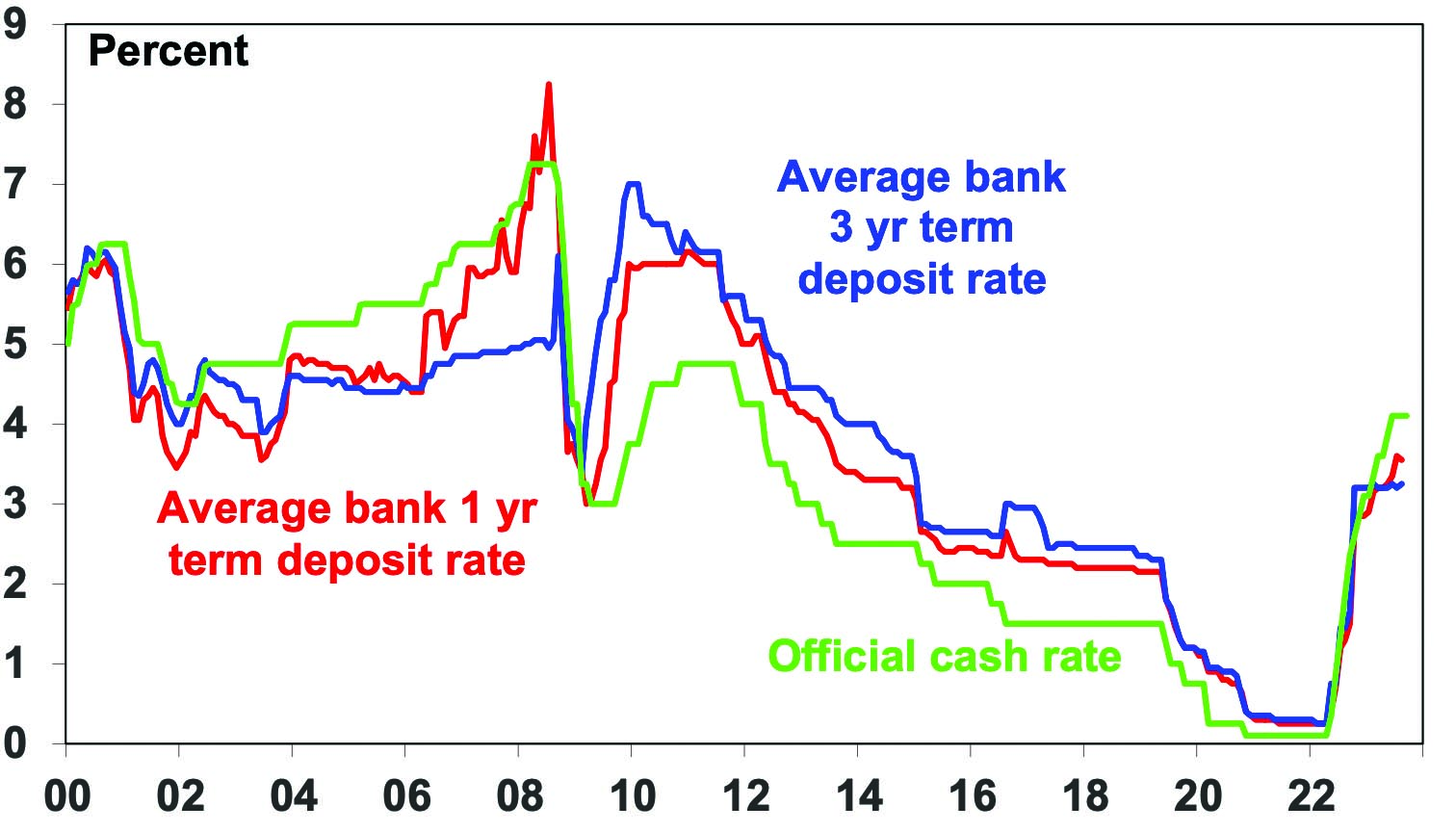

Australian interest rates

Source: RBA, AMP

The RBA retains a tightening bias

The RBA no doubt considered again whether to hike or hold before opting to hold. In this regard it noted that since the last meeting new information has been broadly in line with their expectations, the October CPI suggests inflation continues to moderate and it doesn’t expect much further rise in wages growth. However, it continues to stress the importance of returning inflation to target and keeping inflation expectations down and remains concerned about sticky services inflation with the jobs market easing but still tight. While the RBA retained the softened wording from the November meeting that “whether further tightening of monetary policy is required…will depend upon the data and the evolving assessment of risks” it’s clear that it retains a bias to raise rates again.

There is no meeting in January but by the February meeting the RBA will have December quarter inflation data, two more rounds of retail sales and jobs data and revised RBA forecasts – so all of these will be critical. Given its hawkish bias our view is that the risk of another rate hike remains high at around 40% – and if it occurs it will be at the February meeting.

The case for rates being at the top

We have been way too optimistic as to how far the RBA would raise the cash rate, but our view remains that the RBA has done more than enough to bring inflation back to target and that we are likely at the peak in rates.

First, while the economy has been far more resilient than we expected when rate hikes started 19 months ago its well known in the words of Milton Friedman that “monetary actions affect economic conditions only after a lag that is both long and variable”. This can be up to 18 months or more. This is because it takes a while for the hikes to be passed through to borrowers and for them to adjust their spending and for this to impact companies and jobs. The experience of the late 1980s in Australia where the cash rate was raised from 10.5% to 18% though 1988 and 1989 but unemployment kept falling, only for the economy to fall into recession in 1990 is a classic example of these lags at work. (Rates were higher then, but the level of household debt to income was one third current levels.)

RBA rate hikes & unemployment in the late 1980s/early 1990s

Source: ABS, AMP

This time around the lag has likely been lengthened by savings buffers built up in the pandemic, the reopening boost, more than normal home borrowers locking in at 2% or so fixed rates and “labour hoarding” boosting employment. However, these protections are likely now wearing off.

The 13 rate hikes since May last year mean that a variable rate borrower with a $600,000 mortgage will have seen around an extra $17,000 a year added to their mortgage payments. Most may have sought a better deal but even if they got a 0.5% discount on their mortgage rate it would now amount to an extra $14,900 in extra mortgage payments. This has already seen housing debt interest payments as a share of household income double from their lows with scheduled total payments rise to a record share of income. It’s hard to see this not having a big impact on household spending. Particularly given the RBA’s analysis based on variable and fixed borrowers that around one in seven households with a mortgage were already cash flow negative in July, which will likely be higher by now.

Secondly, while the data is noisy, we are seeing ongoing evidence that rate hikes are biting with real per person retail sales down 4% on a year ago and the ABS’s Monthly Household Spending Indicator pointing to now falling real consumer spending, a sharp fall in building approvals from their highs, slowing business investment plans, job vacancies well down from their highs, unemployment starting a modest rising trend and now signs that home price gains are slowing again. Combined this is likely to continue to bear down on underlying inflationary pressures. And while a surge in petrol prices was a concern a month ago global oil prices have since turned down again and this is flowing through to lower petrol prices.

Retail sales growth

Source: ABS, AMP

Thirdly, the news on Australia inflation has improved after a setback in August and September and points to an ongoing fall. The Monthly CPI indicator for October came in far less than expected at 4.9%yoy, down from 5.6%, with an implied monthly fall of 0.3% mom. Of course, the monthly CPI can be very volatile, various subsidies impacted in October, key services (like hairdressing, dental and pet services weren’t measured) and underlying measures of inflation fell by less so there is a case to be cautious, but the good news is that the downtrend looks to be resuming.

Monthly CPI Indicator versus Quarterly CPI

Source: ABS, AMP

Consistent with this, our Australian Pipeline Inflation Indicator points to a further fall in inflation ahead.

Australia Pipeline Inflation Indicator

Source: AMP

In fact, monthly inflation could have a three in front of it by December. While some fret that Australian inflation is now well above the circa 3% yoy rates that apply in the US, Canada and Europe it should be recalled that Australian inflation lagged on the way up and peaked three to six months later and it’s doing the same on the way down so there is no reason to be alarmed that its currently higher. In fact, with monthly rises in November and December 2022 of 0.9% mom and 1.5% mom to drop out respectively in the next two months’ CPI releases we are likely to see monthly inflation with a three in front of it by year end. This will bring Australian inflation more into line with US, Canadian and European inflation.

Fourthly, the decline in global inflation points to a broader easing in global inflation pressure which will benefit Australia and it highlights that monetary policy still works in slowing inflation and so there is no reason why it shouldn’t work here too.

Finally, it should be noted that while the RBA has not raised its key policy rate as much as in other comparable countries (5% in Canada, 5.25% in the UK, 5.37% in the US & 5.5% in NZ), the rise in actual outstanding mortgage rates exceeds that in most other countries (reflecting the higher reliance on short dated borrowing here) implying a much bigger hit to households.

Changes in outstanding mortgage rates since 2021

Note this data is mostly only available up to Sept/Oct. Source: Macrobond, RBA, AMP

Concluding comment

The short-term risk for interest rates still remains on the upside given the RBA’s own tightening bias – so we are allowing for a 40% risk of another hike which would most likely come in February if it occurs. Yet continuing to raise interest rates will only add to the already very high risk of recession, particularly given the uncertainty around the long and variable lags with which rate hikes impact the economy meaning that there is a big impact yet to fully show up. As a result, the economy is likely to slow further into next year which along with supply chain improvements is likely to push headline inflation down to three point something earlier than the RBA is allowing. As a result, our base case is that the cash rate has peaked with rate cuts starting in the second half of next year. Key to watch will be the global economy, household spending, inflation and the labour market.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital December 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Five reasons to expect the $A to rise – providing recession is avoided

Changes in the value of the Australian dollar are important for Australian investors as they directly impact the value of international investments and indirectly effect the performance of domestic assets like shares via the impact on Australia’s global competitiveness. They also impact the cost of travelling overseas and import prices. But currency movements are also very hard to get right.

Read MoreIntroduction

Changes in the value of the Australian dollar are important for Australian investors as they directly impact the value of international investments and indirectly effect the performance of domestic assets like shares via the impact on Australia’s global competitiveness. They also impact the cost of travelling overseas and import prices. But currency movements are also very hard to get right. Over the last few years, the $A has been soft. This note takes a look at the outlook for the $A.

Why has the $A been so soft?

Since reaching $US0.80 in February 2021 the $A has fallen leaving it below its average levels of the last few decades.

The $A and the $US v major currencies

Source: Bloomberg, AMP

The downtrend since February 2021 reflects a combination of:

-

The initial slow reopening of the Australian economy from the pandemic relative to the US and Europe.

-

Worries about a hit to global growth from the inflation surge and higher interest as the $A tends to be sensitive to global growth given Australia’s high proportion of commodity exports.

-

This has been accentuated by worries about China with lockdowns last year, a patchy recovery this year and property sector worries.

-

A downtrend in commodity prices after an initial boost mainly to energy prices from the Ukraine war.

-

Less rate hikes from the RBA, compared to the US Federal Reserve which has reduced the incentive for investors to park their cash in Australia. As evident in the next chart the $A tends to fall when the gap between the RBA’s cash rate and the Fed Funds rate narrows (highlighted with arrows) as over the last two years and vice versa.

The interest rate gap between Aust and the US versus the $A

The dashed part of the rate gap line reflects money mkt expectations. Source: Bloomberg, AMP

-

Relative strength in the $US generally (see the first chart above) as it tends to benefit in times of global uncertainty.

But there are five reasons to expect the $A to rise

After hitting a low of around $US0.63 in October the $A has risen to nearly $US0.66 and there’s good reason to expect a further rise.

-

Firstly, from a long-term perspective the $A is somewhat cheap. The best guide to this is what is called purchasing power parity (PPP) according to which exchange rates should equilibrate the price of a basket of goods and services across countries – see the next chart.

The $A is below fair value based on relative prices

Source: RBA, ABS, AMP

If over time Australian prices and costs rise relative to the US, then the value of the $A should fall to maintain its real purchasing power. And vice versa if Australian inflation falls relative to the US. Consistent with this the $A tends to move in line with relative price differentials – or its purchasing power parity implied level – over the long-term. Over the last 25 years it has swung from being very cheap (with Australia being seen as an old economy in the tech boom) to being very expensive into the early 2010s with the commodity boom. Right now, it’s back to being modestly cheap again.

-

Second, relative interest rates are starting to swing in Australia’s favour with increasing signs that the Fed is at the top whereas there is still a high risk that the RBA will hike rates further. Money market expectations show a narrowing gap between the RBA’s cash rate and the Fed Funds rate – see the relative interest rate chart above. More broadly the $US is expected to fall further as US interest rates top out.

-

Third, global sentiment towards the $A is somewhat negative and this is reflected in short or underweight positions. In other words, many of those who want to sell the $A may have already done so and this leaves it vulnerable to a further rally if there is any good news.

$A positioning remains short

Source: Bloomberg, AMP

-

Fourth, commodity prices look to be embarking on a new super cycle. The key drivers are the trend to onshoring reflecting a desire to avoid a rerun of pandemic supply disruptions and increased nationalism, the demand for clean energy and vehicles and increasing global defence spending all of which require new metal intensive investment compounded by global underinvestment in new commodity supply. This is positive for Australia’s industrial commodity exports.

Long term bull and bear markets in commodity prices

Source: Bloomberg, AMP

-

Finally, reflecting continuing relatively high energy and iron ore prices Australia is continuing to run a current account surplus, albeit its down from recent highs (as gas & coal prices have fallen back and Australians have resumed travelling internationally). The swing into a current account surplus means Australia is a capital exporter and that there is more natural transactional demand for the $A than supply.

Aust current account surplus till very high

Source: ABS, AMP

Where to from here and what is the main risk?

We expect the combination of a slightly more hawkish RBA, a falling $US at a time when the $A is undervalued and positioning towards it still short to push the $A higher into next year, likely taking it back above $US0.70.

The main risk is if the global and/or Australian economies slide into recession next year – this is not our base case but it’s a very high risk and if it occurs it could result in a new leg down in the $A as it is a growth sensitive currency and a rebound in the relatively defensive $US.

What would a further rise in the $A mean for investors?

For Australian based investors, a rise in the $A will reduce the value of an international asset (and hence its return), and vice versa for a fall in the $A. The decline in the $A over the last few years has enhanced the returns from global shares in Australian dollar terms. So, when investing in international assets, an Australian investor has the choice of being hedged (which removes this currency impact) or unhedged (which leaves the investor exposed to $A changes). Given our expectation for the $A to rise further into next year there is a case for investors to tilt towards a more hedged exposure of their international investments.

However, this should not be taken to an extreme for two key reasons. First, currency forecasting is hard to get right. And with recession risk remaining high the rebound in the $A could turn out to be short lived. Second, having foreign currency in an investor’s portfolio via unhedged foreign investments is a good diversifier if the economic and commodity outlook turns sour. As can be seen in the next chart there is a rough positive correlation between changes in global shares in their local currency terms and the $A. Major falls in global shares which are circled in the next chart saw sharp falls in the $A which offset the fall in global shares for Australian investors. So having an exposure to foreign exchange provides good protection against threats to the global outlook.

Global share prices versus $A

Source: Bloomberg, AMP

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital November 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Nine key things for successful investing

There is an ever-present worry list surrounding investment markets – usually involving some combination of concerns about economic activity, inflation, profits, interest rates, politics, natural calamities, wars, etc. It makes it hard for investors to stay focussed and avoid silly mistakes. Uncertainty is magnified by perennial predictions of a crash and then periodically by talk of the next best thing

Read MoreIntroduction

There is an ever-present worry list surrounding investment markets – usually involving some combination of concerns about economic activity, inflation, profits, interest rates, politics, natural calamities, wars, etc. It makes it hard for investors to stay focussed and avoid silly mistakes. Uncertainty is magnified by perennial predictions of a crash and then periodically by talk of the next best thing that’s going to make us rich.

It would be nice if the investment world was neat and predictable, but it’s well known for sucking investors in during good times and spitting them out during bad times. If anything, it’s getting harder reflecting a surge in the flow of information and opinion. This has been magnified by social media where everyone is vying for attention and the best way to get this is via headlines of impending crisis. This all adds to investor uncertainty and erratic investment decisions.

With this in mind, I have written regularly about nine key things for investors to bear in mind to be successful. This note provides a reminder.

1. Make the most of the power of compound interest

Making the most of compound interest – which refers to the way returns compound on past returns for an investor over long periods – is the most important thing an investor needs to do if they want to build wealth. It works best for growth assets. The next chart shows the value of one dollar invested in 1900 in Australian cash, bonds and equities with interest and dividends reinvested along the way, before fees and taxes. That one dollar would be worth $253 today if it had been invested in cash. But if it had been invested in bonds it would be worth $879 and if it was allocated to shares it would be worth $752,213. Although the average return on shares (11.6% pa) is just double that on bonds (5.9% pa), the magic of compounding higher returns leads to a substantially higher balance. The same applies to other growth assets like property. So, the best way to build wealth is to take advantage of the power of compound interest and have a decent exposure to growth assets. Of course, there is no free lunch and the price for higher returns is higher volatility but the impact of compounding returns from growth assets is huge over long periods.

Shares versus bonds & cash over the very long term – Australia

Source: ASX, Bloomberg, RBA, AMP

The volatility set off by the pandemic and now flowing from high inflation and interest rate increases does nothing to change this, any more than previous setbacks (highlighted with arrows) like WW1, the Great Depression, the 1973-74 bear market, the 1987 crash or the GFC did. The likely end of the secular decline in inflation and interest rates over the last few decades which super charged investment returns means average returns over the next decade or so will be somewhat more constrained than we have become used to. But shares offering a dividend yield of 4% (5% or more with franking credits) should still provide superior medium-term returns and hence grow wealth better than bonds where the 10-year yield is 4.50% pa. Unfortunately making the most of the magic of compounding returns can be one of the hardest things to do.

2. Don’t get thrown off by the cycle

This is often because investment markets go through cyclical swings. All eventually set up their own reversal – eg, as falls make shares cheap and low interest rates help them rebound. But the outcome is extreme volatility in short term returns as evident in the next chart which shows the pattern of rolling 12 month ended returns in Australian shares (compared to rolling 20 year ended returns).

Australian share returns over rolling 12 mth & 20 yr periods

Source: ASX, Bloomberg, RBA, AMP

The trouble is that cycles can throw investors off a well thought out investment strategy that aims to take advantage of the power of compounding longer-term returns. But cycles also create opportunities. Looked at in a long term context, the 20% or so plunge in share seen into October last year was just another cyclical swing, after which markets rebounded. The key is not to get thrown off when markets plunge.

3. Invest for the long term

Looking back, it always looks obvious as to why things happened and dips in investment markets look like great buying opportunities. But looking forward the future is shrouded in uncertainty. And no-one has a perfect crystal ball. As JK Galbraith observed “there are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” Usually the grander the forecast the greater the need for scepticism as such calls invariably get the timing wrong or are dead wrong. If getting markets right were easy, then the prognosticators would be mega rich and would have stopped doing it. Related to this many get it wrong by letting blind faith – eg, “there is too much debt” – get in the way of good decisions. They may be right one day, but an investor can lose a lot in the interim. The problem is that it’s not getting easier as the world is getting noisier. This has all been evident through the pandemic and its high inflation aftermath with all sorts of forecasts as to where markets would go, most of which provided little help in actually getting the big swings right. Given the difficulty in getting market moves right in the short-term, for most it’s best to get a long-term plan that suits your level of wealth, age, tolerance of volatility, and stick to it. Focus on the green 20-year return line in the previous chart rather than short term swings.

4. Diversify

Don’t put all your eggs in one basket. Having a well-diversified portfolio will provide a much smoother ride. For example, global and Australian shares provide similar returns over the very long term but go through long periods of relative out and underperformance (eg, Australian shares outperformed in the mining boom years but global shares have outperformed since). Similarly listed assets (like shares) and unlisted assets (like property) often perform differently through the cycle. The key is to have a mix of investments.

5. Turn down the noise

After having worked out a strategy that’s right for you, it’s important to turn down the noise on the information flow and prognosticating babble and stay focussed. The trouble is that the digital world is driving an explosion in information and opinions about economies and investments. But much of this information and opinion is of poor quality. As “bad news sells” there has always been pressure to put the negative news on the front page of newspapers but there was hopefully some balance in the rest of the paper. In a digital world each story can be tracked via clicks so the pressure to run with sensationalised and often bad news headlines is magnified. This has gone into hyperdrive since the pandemic – with a massively stepped up flow of economic information. This may be of use in providing timely information on how the economy is travelling but it’s also added immensely to the flow of information and often it’s contradictory. The heightened uncertainty is leading to shorter investment horizons which in turn can add to the risk that you could be thrown off well thought out investment strategies. The key is to turn down the volume on all this noise. This also means keeping your investment strategy relatively simple. So don’t waste too much time on individual shares or funds as it’s your high-level asset allocation that will mainly drive the return and volatility you will get. Here are several tips to help turn down the noise:

-

Put the worries in context – there have been plenty of worries over the last century and yet long-term investment returns have been fine.

-

Recognise it’s normal for markets to swing around in the short term.

-

Focus on only a few reliable news services and turn off all “notifications” on your smart device.

-

Don’t check your investments so regularly – on a day-to-day basis it’s a coin toss as to whether the share market will rise or fall but the longer you stretch it out between looking at your investments the more likely you will get positive news. See the next chart.

Percentage of positive share market returns

Source: Bloomberg, AMP

6. Buy low, sell high

The cheaper you buy an asset (or the higher its yield), the higher its prospective return will likely be and vice versa, all other things being equal. So as far as possible it makes sense to buy when markets are down and sell when they are up. Unfortunately, many do the opposite, ie, selling after a collapse and buying after a big rally…which just has the effect of destroying wealth even though it might feel good at the time in the midst of a panic (or euphoria). Again, turn down the noise!

7. Beware the crowd at extremes

It often feels safe to be in a crowd and at times the investment crowd can be right. However, at extremes the crowd is invariably wrong – whether it’s at market highs like in the late 1990s tech boom or market lows like in March. The problem with crowds is that eventually everyone who wants to buy in a boom (or sell in a bust) will do so and then the only way is down (or up after crowd panics). As Warren Buffet has said the key is to “be fearful when others are greedy and greedy when others are fearful”.

8. Focus on investments with sustainable cash flow

If it looks dodgy, hard to understand or has to be based on obscure valuation measures then it’s best to stay away. Most cryptocurrency “investments” are a classic example of this. If an investment looks too good to be true it probably is. By contrast, assets that generate sustainable cash flows (profits, rents, interest) and don’t rely on excessive gearing or financial engineering are more likely to deliver.

9. Seek advice

We are all susceptible to psychological traps like the tendency to over-react to current investment market conditions, or to pay more attention to information and opinion that confirms our own views. And the increasing complexity of investing makes it anything but easy. However a good approach is to seek advice via an investment information and/or advisory service or a coach such as a financial adviser, in much the same way you might use a specialist to look after your plumbing or medical needs. As with plumbers and doctors it pays to shop around to find a service or adviser you are comfortable with and can trust.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital November 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Australian home prices up on supply shortfall, but at risk from high rates

The big surprise in the Australian housing market last year was how quickly home prices fell with RBA rate hikes. But the big surprise this year is how they rebounded when most including myself were looking for further falls. October CoreLogic data showed another 0.9% rise in national home prices, leaving them just 0.5% below their April 2022 record.

Australian dwelling

Read MoreIntroduction

The big surprise in the Australian housing market last year was how quickly home prices fell with RBA rate hikes. But the big surprise this year is how they rebounded when most including myself were looking for further falls. October CoreLogic data showed another 0.9% rise in national home prices, leaving them just 0.5% below their April 2022 record.

Australian dwelling price growth, to October

|

|

Oct % chg |

Annual % chg |

% recent peak to low |

% recent low to now |

|

Sydney |

0.8 |

9.0 |

-12.4 |

11.6 |

|

Melbourne |

0.5 |

2.4 |

-7.9 |

4.5 |

|

Brisbane |

1.4 |

7.8 |

-8.9 |

10.5 |

|

Adelaide |

1.3 |

6.5 |

-1.7 |

7.7 |

|

Perth |

1.6 |

10.8 |

-0.6 |

11.0 |

|

Hobart |

0.8 |

-4.9 |

-12.2 |

0.8 |

|

Darwin |

-0.1 |

-1.7 |

-5.1 |

2.5 |

|

Canberra |

0.1 |

-1.6 |

-7.9 |

1.3 |

|

National avg |

0.9 |

5.6 |

-7.5 |

7.6 |

Source: CoreLogic, AMP

After the initial rebound earlier this year we came to the conclusion that prices had bottomed and would rise another 5% next year. This remains our view, but the outlook for the property market is more uncertain than normal as the property market is caught between the extremes of a supply shortfall and the negative impact of higher interest rates – both of which are still playing out and are getting more extreme.

Supply shortfall still dominating for now

The rebound in prices reflects a far worse than expected shortfall of supply relative to underlying demand for homes as immigration rebounded driving the fastest population growth rate since the 1950s at the same time that the supply of new dwellings slowed. This accentuated already tight rental markets, forcing rents up & driving renters to consider buying. So, demand improved but supply remains weak with total listings below normal. Talk of rising prices and shortages further boosted demand from less interest rate sensitive buyers. Expectations that rates were at or close to the top have also helped. Looking at the key elements of this:

-

Net immigration looks to have been around 500,000 in 2022-23, more than double the 235,000 forecast in last October’s budget. And monthly arrivals suggest it’s continuing to surge this financial year.

Surging Australian net immigration

Source: ABS, AMP

-

This along with the constrained completion of new homes (with material and labour shortages and falling approvals) has meant an ongoing rise in the accumulated undersupply of housing, estimated to be 120,000 dwellings, rising to 190,000 dwellings by mid next year.

Home construction versus population growth

Population estimates based on recent data for 2022-23 and 2023-24, then Australian Budget forecasts for 2024-25. Source: ABS, Australian AMP

-

The Government’s commitment to produce 240,000 dwellings a year over five years is great news but only starts from July 2024 and may struggle as we only completed 187,000 pa over the last five years.

-

Tight housing supply is reflected in record low rental vacancy rates and surging rents, which in turn is driving some to try and buy.

Falling vacancy rates, rising rents

Source: REIA, AMP

So strong population driven housing demand, constrained supply and an existing shortfall remains a strong source of support for home prices.

But high rates may start to get the upper hand again

However, even when there is a supply shortfall, interest rates still matter.

-

The long-term bull market in property prices from the 1980s was underpinned by the shift from high inflation and high interest rates to low inflation and low interest rates which allowed a rise in home price to income levels and a similar rise in household debt. This valuation effect boosted house prices by around 3.3% pa, accounting for 46% of the total increase in house prices since the early 1980s. So, if we have moved into a more inflation prone world with higher average interest rates this structural boost has run its course & could start to reverse.

-

Australian housing remains very expensive on all metrics – home price to income ratios are only just below record highs; they are at the high end of comparable countries; and the time taken to save for a 20% deposit has more than doubled over the last 40 years from less than 5 years to now more than 10.

Ratio of home prices to wages and incomes

Sources: ABS, CoreLogic, AMP

-

The rise in interest rates since May last year has caused a big hit to home buyer “capacity to pay”. We estimate that the capacity to pay for a home by a borrower with a 20% deposit on full time average earnings is around 29% lower than it was in April last year as they can’t borrow as much now on a given income. See the next chart. This threatens a downwards adjustment in home prices at some point unless incomes rise dramatically or mortgage rates fall dramatically. It may have been offset this year by a pool of less interest sensitive buyers (eg, those who had access to the bank of Mum and Dad) but that leaves the market vulnerable if such buyers are exhausted.

Australian home prices versus capacity to pay

Source: RBA, CoreLogic, AMP

-

Australians continue to see this as a poor time to buy homes consistent with very depressed levels of consumer confidence generally. This makes the current upswing in home prices unusual as it’s normally accompanied by improved sentiment towards property.

Consumer housing sentiment and home prices

Source: Westpac/Melbourne Institute, CoreLogic, AMP

-

New listings are trending up and are likely to be boosted by increased listings from distressed sellers, including investors with rental yields falling further below mortgage rates. Measures of mortgage stress are continuing to rise. Mortgage interest payments as a share of household income are rising to record levels and scheduled payments are already at a record according to the RBA. And combining the RBA’s own analysis for variable and fixed rate borrowers one in seven home borrowers were estimated to be in negative cash flow as at July. This will worsen if the RBA raises rates further as appears likely.

-

Just as rate hikes impact the economy with a lag it’s the same with the property market. This is because it takes time for rate hikes to cool demand, for unemployment to rise and for distressed sales to increase. So last year’s slump in property prices that started as soon as interest rates started to rise maybe ran ahead of itself. Similarly, the last three major cyclical upswings in home prices have required lower interest rates to be sustained. With rates cuts still a long way away, the impact of past rate hikes still feeding through to demand and listings, and the RBA looking like it will raise rates again, the risk of another leg down in prices is high.

Interest rate moves normally impact prop prices with a lag

Arrows show the lagged lead from rate hikes to price falls. Source: CoreLogic, RBA, AMP

Concluding comment

The combination of slowing home price growth since May (when it peaked at 1.2% month on month), slowing auction clearance rates from the low to mid 70% range to the low to mid 60% range and weak growth in housing finance suggest that housing demand is struggling to keep up with listings. The supply shortfall in the face of strong demographic demand has had the upper had this year but high interest rates and their lagged impact look to be starting to reassert themselves. The headwinds of high interest rates and poor affordability will likely constrain the upswing at the very least and so our base case remains for price growth to slow to 5% next year. But it also means there is a very high risk of another leg down in average home prices emerging next year, particularly if unemployment rises significantly. After surprising on the upside this year, they may surprise on the downside next year! Interest rates, unemployment and auction clearance rates are key indicators to watch.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital November 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Five constraints on medium term investment returns

Starting in the early 1980s investment returns were spectacularly strong. Sure there were bumps along the way like the 1987 share crash, but Australian balanced growth superannuation funds returned an average 14.1% pa in nominal terms and 9.4% pa in real terms (i.e. after inflation) between 1982 and 1999. And that was after taxes and fees. This was well above

Read MoreIntroduction

Starting in the early 1980s investment returns were spectacularly strong. Sure there were bumps along the way like the 1987 share crash, but Australian balanced growth superannuation funds returned an average 14.1% pa in nominal terms and 9.4% pa in real terms (i.e. after inflation) between 1982 and 1999. And that was after taxes and fees. This was well above what would normally be expected from such funds.

Balanced/growth superannuation fund returns

Source: Mercer Investment Consulting, Morningstar, AMP

Since 2000 nominal super returns have been more constrained averaging 6.2% pa as we entered a lower return world with real returns averaging 3.6% pa. Mind you this is still pretty good considering that 1 year bank term deposit rates averaged just 3.7% pa and only 1.1% pa after inflation and that was before taxes. The odds are that returns are likely to be even more constrained over the next 5 to 10 years. This note looks at why.

What drove the strong returns from the early 1980s?

There was an element of mean reversion (or payback) after the poor returns of the high inflation 1970s. But fundamental drivers were:

-

Economic rationalist policies – deregulation, privatisation, competition reforms, tax reform and free trade – as policy makers focussed on supply side reforms in reaction to the inflation of the 1970s.

-

Globalisation which boosted trade & competition and lowered costs.

-

Easing geopolitical tensions with the ending of the Cold War in 1989 which led to the peace dividend of reduced defence spending.

-

Corporate focus on return on capital.

-

Positive demographics as baby boomers entered peak consumption and peak productivity.

-

Inflation targeting by independent central banks with a focus on keeping inflation and inflation expectations at low levels.

-

And, of course, the tech boom of the 1990s.

Taken together this drove low inflation and strong productivity growth which underpinned a secular bull market in shares – which are the biggest exposure in balanced growth super funds – through the 1980s and 1990s. See the next chart. It paused in the US in 2000-2013 but then took off in Australia with the 2000s resources boom only to take off in the US again from 2013 helped by ever lower interest rates into the pandemic (which pushed up the value of shares and other growth assets). Meanwhile bond returns were high given their high starting point yields in the early 1980s.

Long term bull and bear phases in US shares

Since 1900 there have been four major secular bull markets in US shares: the 1920s (with electricity; chemicals & mass production); the 1950s and 60s (with petro chemicals, electronics & aviation); the 1980s and 90s (see the text); and since 2013. Source: Bloomberg, R Shiller, AMP

Megatrends – five key constraints on returns

Unfortunately, the drivers of strong returns from the 1980s are reversing. There are five megatrends of relevance (see here for more detail).

1. Bigger government, less economic rationalist policies

As a result of the problems highlighted by the GFC, rising inequality, stagnant real wages, aging populations, climate change, the success of government income support in the pandemic, the rise of populism and a collective memory loss regarding the lessons of the past there is a backlash against economic rationalist policies and more support for big government. It’s evident in Australia, with the rising share government spending, widespread support for higher taxes and labour market reregulation. The risk is lower productivity & higher inflationary pressure.

2. The reversal of globalisation

The post-WW2 period saw a huge surge in global trade and financial links between countries as more countries entered the global trading system and trade barriers collapsed. This saw production allocated globally according to comparative advantage and highly integrated global supply chains. The cost reductions and competition helped reduce inflation. But the trend towards freer trade stalled in the 2000s and trade barriers are on the rise. The pandemic, rising geopolitical tensions and rising nationalism are accelerating this. Support for free trade policies has faded in favour of friendshoring, onshoring and old-fashioned protectionism to support manufacturing locally, eg, with subsidies for battery projects and electric vehicles. Inevitably this will lead to higher costs.

3. Increasing geopolitical tensions – a new cold war

Declining military spending into the 2000s was disinflationary. This was facilitated by the move to a “unipolar” world dominated by the US and increasing believe in free market liberalism. This started to fracture after the GFC and we are now in a “multipolar” less stable world with arguably a new Cold War between China, Russia and Iran on the one hand and Western countries on the other. The war in Ukraine and now Israel are arguably signs of this. This adds to the threat to free trade but also risks increased military spending. This means more demand for metals and more government spending which will add to inflationary pressure.

4. Climate change and decarbonisation

Ultimately the shift to sustainable energy could result in lower costs. But we are a long way from that and climate change and the move to net zero will add to costs and inflation via: extreme weather events; associated rebuilding and higher insurance premiums; costs of mitigation; increased metals demand as economies retool; and increased pollution regulation.

5. Less workers, more consumers

Global population growth is slowing, while in advanced countries and China the working age population is declining. And populations are aging, resulting in a rise in the ratio of children and older people to working aged people. Thanks to its high immigration program Australia is in a somewhat better position. But globally, the upshot is less workers (supply) and more consumers (demand) which will add to inflationary pressures.

Implications for growth and inflation

Taken together these key megatrends risk lowering productivity growth making economies more inflation prone. There is some offset with technological innovation – with artificial intelligence offering significant potential to boost services sector productivity, although this will take time to materialise. But the more inflation prone environment means central banks will have to work harder to keep inflation down, which will require higher and more variable interest rates than we saw pre-pandemic.

The collapse in inflation from the 1980s provided a tailwind for super returns because the fall in interest rates and economic uncertainty allowed growth assets to trade on lower investment yields and higher price to earnings multiples (which boosted capital growth). A more inflation prone world will remove this tailwind and threaten its reversal with cash and fixed interest becoming relatively more attractive, price to earnings ratios on shares settling at lower levels and income yields on real assets at higher levels (which will constrain capital growth).

What does all this mean for medium term returns?

Our approach to get a handle on medium-term (i.e. 5-10 year) return potential of major asset classes is as follows:

-

For bonds, the best predictor of future medium-term returns is current yields. The rise in yields has increased their return potential.

-

For equities, current dividend yields plus trend nominal GDP growth does a good job of predicting medium-term returns.

-

For property, we use current rental yields and likely trend inflation as a proxy for income and capital growth. The surge in online spending and “work from home” means significant downside risks to returns.

-

In the case of cash, we use our forecast cash rate over medium term.

Our latest return projections are shown in the next table. The second column shows each asset’s current income yield, the third shows their 5–10 year growth potential, and the final column shows their total return potential. Note that: we assume inflation averages around 2.5% pa; and we have cautious real economic growth assumptions reflecting the five megatrends noted above. This will likely constrain capital growth.

Projected medium term returns, % pa

|

|

Current Yield # |

Growth |

= Return |

|

World equities |

1.9^ |

4.7 |

6.6 |

|

Emerging equities |

2.2^ |

7.3 |

9.4 |

|

Australian equities |

4.3 (5.6*) |

3.7 |

8.0 (9.3*) |

|

Unlisted commercial property |

4.6 |

2.5 |

7.1 |

|

Australian REITS |

5.0 |

2.5 |

7.5 |

|

Global REITS |

4.0^ |

2.5 |

6.4 |

|

Unlisted infrastructure |

3.9*^ |

3.0 |

6.9 |

|

Australian bonds (fixed interest) |

4.5 |

0.0 |

4.5 |

|

Australian cash |

3.0 |

0.0 |

3.0 |

|

Diversified Growth mix |

|

|

6.7 |

|

Diversified Grth mix* ex tax & fees |

|

|

5.5 |

All returns are pre super taxes & fees except the final row, which is post taxes & fees. # Current dividend yield for shares, net rental yields for property & duration matched bond yield for bonds. ^ Includes forward points. * With franking credits added in. Source: AMP

Key observations

-

After falling for many years due to the fall in starting point yields for major assets the medium-term return potential using this approach has improved to around 6.7% over the last 15 months (see next chart) due to now higher starting point interest rates and bond yields and somewhat higher starting point yields on shares (which remain down in value from record highs) and commercial property.

-

After allowing for taxes and fees this still implies pretty constrained nominal medium term returns for balanced growth super funds based on a traditional mix of assets of 5.5% pa which is a bit below the average since 2000. This is still better than bank term deposit rates which average up to 4.5% before taxes, and makes no allowance for any value added from active investment management.

Projected medium term returns

Source: AMP

-

The main downside risk is that inflation trends higher driving a further trend rise in interest rates, bond yields and yields on shares, property & infrastructure resulting in an ongoing drag on capital growth.

Implications for investors

-

First, have reasonable return expectations. In the past super returns were boosted by very favourable conditions which have now faded.

-

Second, remember there is no free lunch – investment opportunities offering higher returns likely entail much higher risk.

-

Third, medium term returns from super are still likely to be well above bank term deposit rates on an after tax and fees basis.

-

Finally, while bear markets are painful, they push up the medium-term return potential of shares and so provide opportunities.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital October 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

For what it’s worth: why what you pay for an investment is a key driver of its return

It’s logical that the cheaper you buy an asset the higher its prospective return might be. However, this is frequently forgotten with investors often tempted to project recent returns into the future regardless of valuations. A valuation measure for an asset is basically a guide to whether it’s expensive or cheap. This note looks

Read More– and how do valuations look now?

Introduction

It’s logical that the cheaper you buy an asset the higher its prospective return might be. However, this is frequently forgotten with investors often tempted to project recent returns into the future regardless of valuations. A valuation measure for an asset is basically a guide to whether it’s expensive or cheap. This note looks at the main issues.

It’s relatively simple for cash and bonds

An obvious example of where the starting point valuation matters critically is cash. If the interest rate on offer from a term deposit rate is low as was the case into early last year when rates were 0.5% or less then it means pretty poor returns. Recently term deposit rates have increased with the RBA cash rate and so are offering a more attractive return potential, albeit they are still down from levels around 6-7% in 2010.

Bank term deposit rates are well up from their lows

Source: RBA, AMP

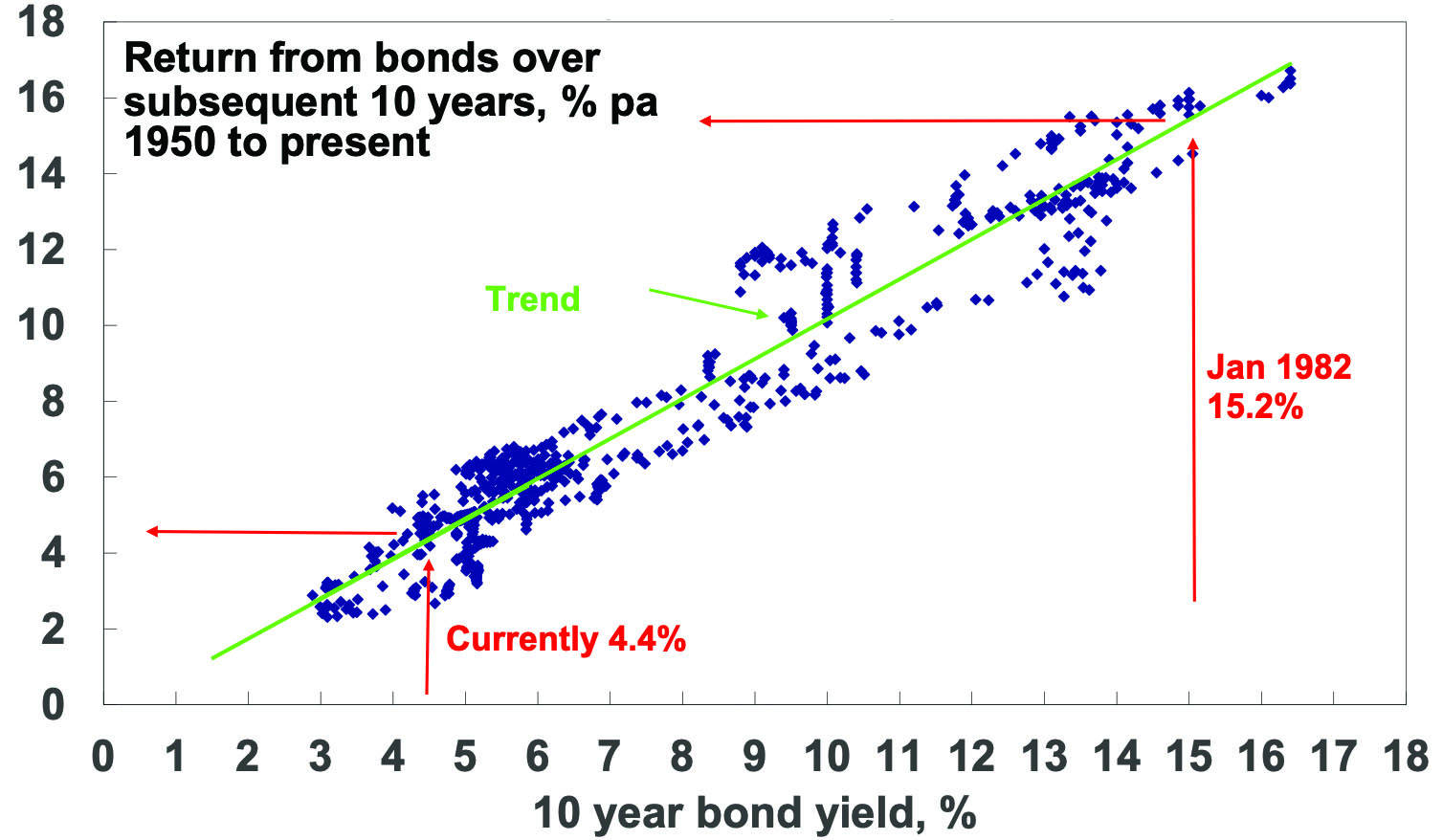

For government bonds in advanced countries the yield is similarly a good guide to starting point value and hence medium-term return potential. Over short-term periods bond prices can move up and down and this influences short term returns, but over the medium term the return a bond investor will get is what bond yields were when they invested. If the yield on a 10-year bond is 5%, and you hold the bond to maturity, your return will be 5%. Of course, the relationship is not perfect but it’s a good guide. This can be seen in the next chart which shows a scatter plot of Australian 10-year bond yields since 1950 (horizontal axis) against subsequent 10 year returns from Australian bonds based on the Composite All Maturities Bond index (vertical axis).

Australian bonds – the higher the bond yield the better the return

Source: Bloomberg, AMP

When bond yields are high, they set up high bond returns over the medium term and vice versa. For example, Australian 10-year bond yields in January 1982 were 15.2% and it’s not surprising that bond returns over the next 10 years were 15.4%. At their low point of 0.6% in 2020 they were pointing to very low returns but they have now increased to around 4.4% pointing to better medium term returns, albeit still historically low.

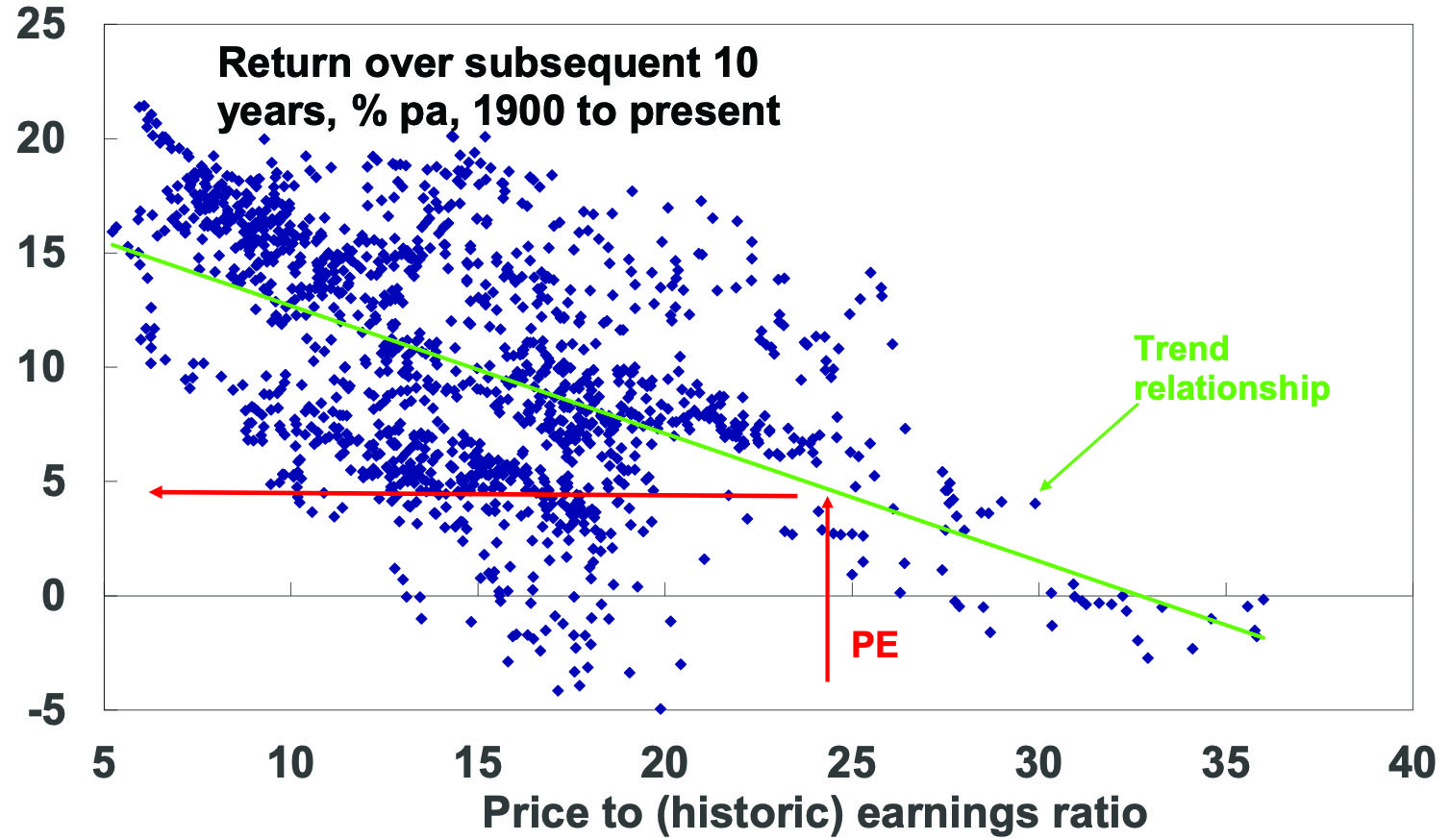

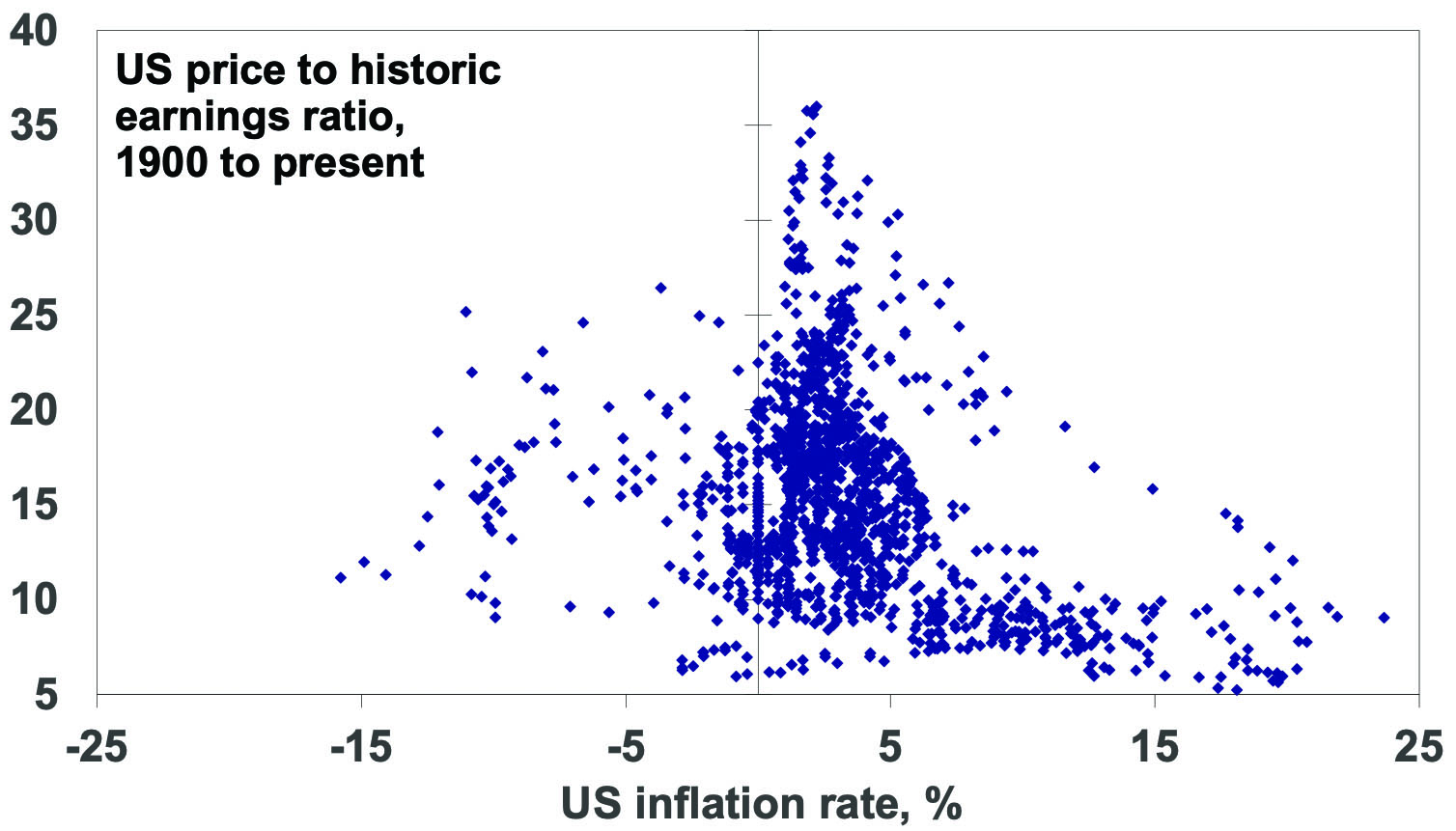

For shares a similar relationship holds. The following chart shows a scatter plot of the price to trailing 12 months earnings ratio for US shares since 1900 (along the horizontal axis) against subsequent 10-year total returns (ie, dividends plus capital growth) from US shares. While the relationship is not as smooth as that for bonds as there is much more involved in share returns, it is a negative relationship. That means when share prices are high compared to earnings, subsequent returns tend to be low and vice versa. The best time for shares is after PEs have fallen to single digits.

US shares – the lower the PE the better the medium term return

Source: Bloomberg, AMP

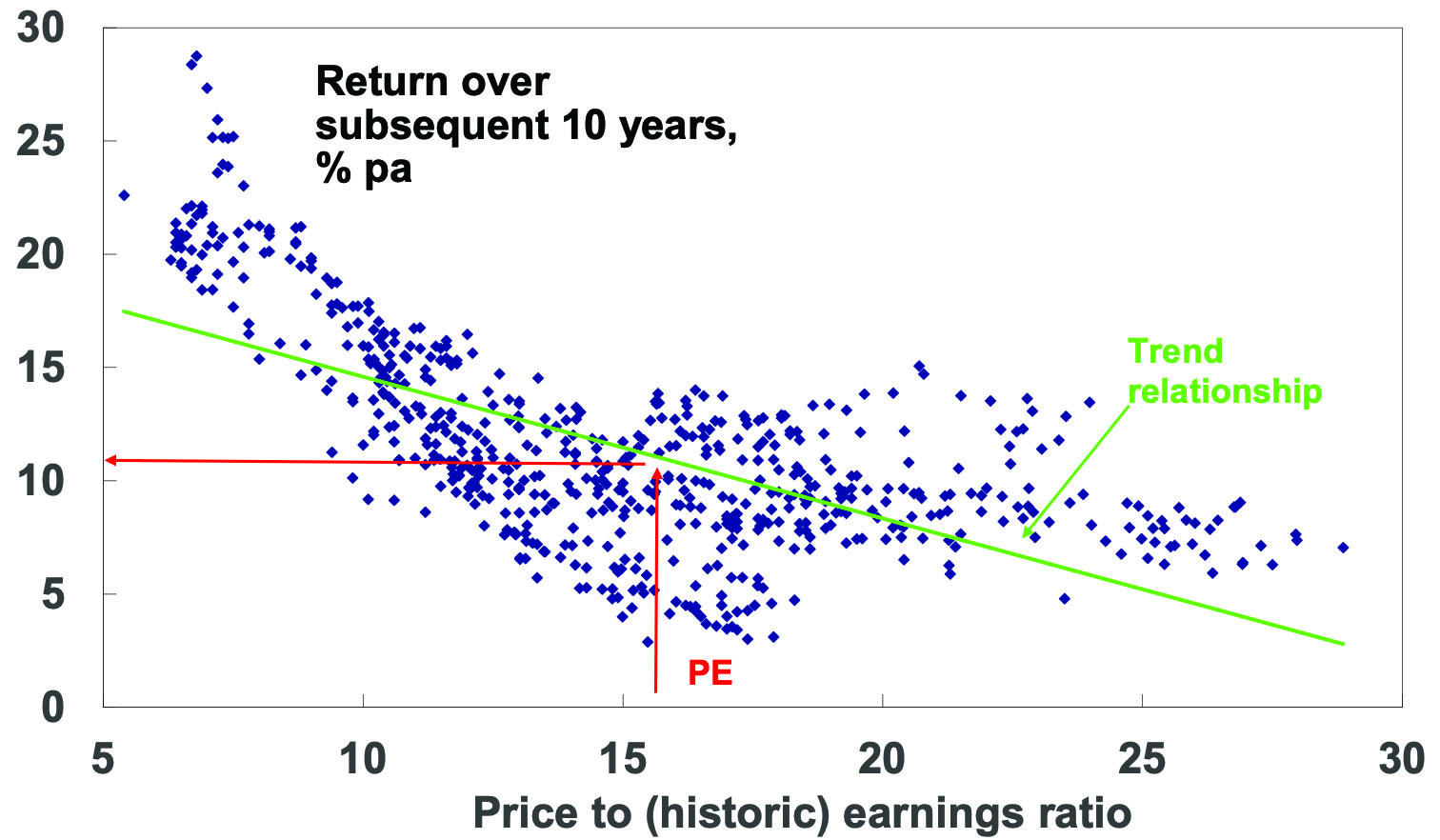

The next chart shows the same for Australian shares from 1962, as a PE series is not available before then. Again, there is the expected negative relationship between the level of the PE and subsequent total returns (based on the All Ords Accumulation Index) with the best returns coming after periods of low PEs. For example, at the end of the mid-1970s bear market in September 1974 the PE was just 5.4 times which was a great time to buy as Australian shares returned 21.8% pa over the next decade.

Aust shares – the lower the PE the better the medium term return

Source: RBA, ASX, AMP Capital

There is dividend yield data for Australian shares from 1900 and as expected the higher it is the better the subsequent return.

The key is that the starting point matters – put simply the higher the yield and the lower the price to earnings ratio (for shares) relative to their history the better for an asset’s medium term return potential.

Of course, valuation is not a perfect guide to returns

But the importance of starting point valuations is often forgotten. Behavioural finance tells us that it’s natural for investors to pay too much attention to recent performance, so after a run of strong years investors expect it will continue. This leads many to buy only after good times, only to find they have bought when shares are overvalued and therefore find themselves locked into poor returns. And vice versa after a run of poor returns. So, when valuations matter the most, they often get ignored. But of course, valuations can have their own pitfalls.

-

First, you need to allow for risk as sometimes assets are cheap for a reason. This can be an issue with individual shares, eg, a tobacco company subject to lawsuits even though current earnings are fine.

-

Second, valuation is a poor guide to market timing, often being out by years. To paraphrase John Maynard Keynes, the market can remain expensive (or cheap) for longer than you can remain solvent. For example, economist Robert Shiller’s call that US shares were exhibiting “irrational exuberance” in 1996 was four years before the tech wreck & shorting them in 1996 would have sent an investor bust.

-

Third, there is a huge array of valuation measures when it comes to shares. For example, the “earnings” in the PE can be actual historic earnings as reported for the last 12 months, consensus earnings for the year ahead or earnings that have been smoothed to remove cyclical distortions. All have pros and cons. For example, the historic PE is based on actual data, but it can give the wrong signal during or after of a recession as earnings may be depressed making shares look far more expensive than they actually are.

-

Finally, the appropriate level of valuation will vary with inflation and interest rates. In times of low inflation, assets can trade on lower yields as the yield structure in the economy falls, uncertainty falls and (for shares) the quality of reported earnings improves. This means higher PEs. So low inflation, say down to 2%, can be good for shares via higher PEs as seen in the next chart. The shift from the high inflation of the 1970s and 1980s to the low inflation last decade was very positive for shares. But if inflation rises resulting in higher interest rates, then shares should trade on lower PEs as investors find shares less attractive, uncertainty rises and earnings quality falls. This of course was a major factor weighing on share markets last year.

US shares – Low inflation = higher PEs

Source: Bloomberg, AMP Capital

To get technical: share prices in theory should equal the present value of future dividends discounted by the required rate of return which equals the risk-free interest rate (usually seen as government bond yields) plus a return premium to cover the higher volatility of shares. It follows from this that shares should trade on higher price to earnings ratios when interest rates fall and vice versa when they rise, all other things being equal. This is why interest rates can’t be ignored when valuing shares.

Current valuation signals

Right now, starting valuation signals are as follows:

Cash – Cash and term deposit rates at 4% or so are far more attractive than was the case two years ago but are still below the rate of inflation.

Bonds – Bond yields at 4% or more are far more attractive than was the case two years ago, pointing to much improved medium term return potential albeit it’s still constrained.

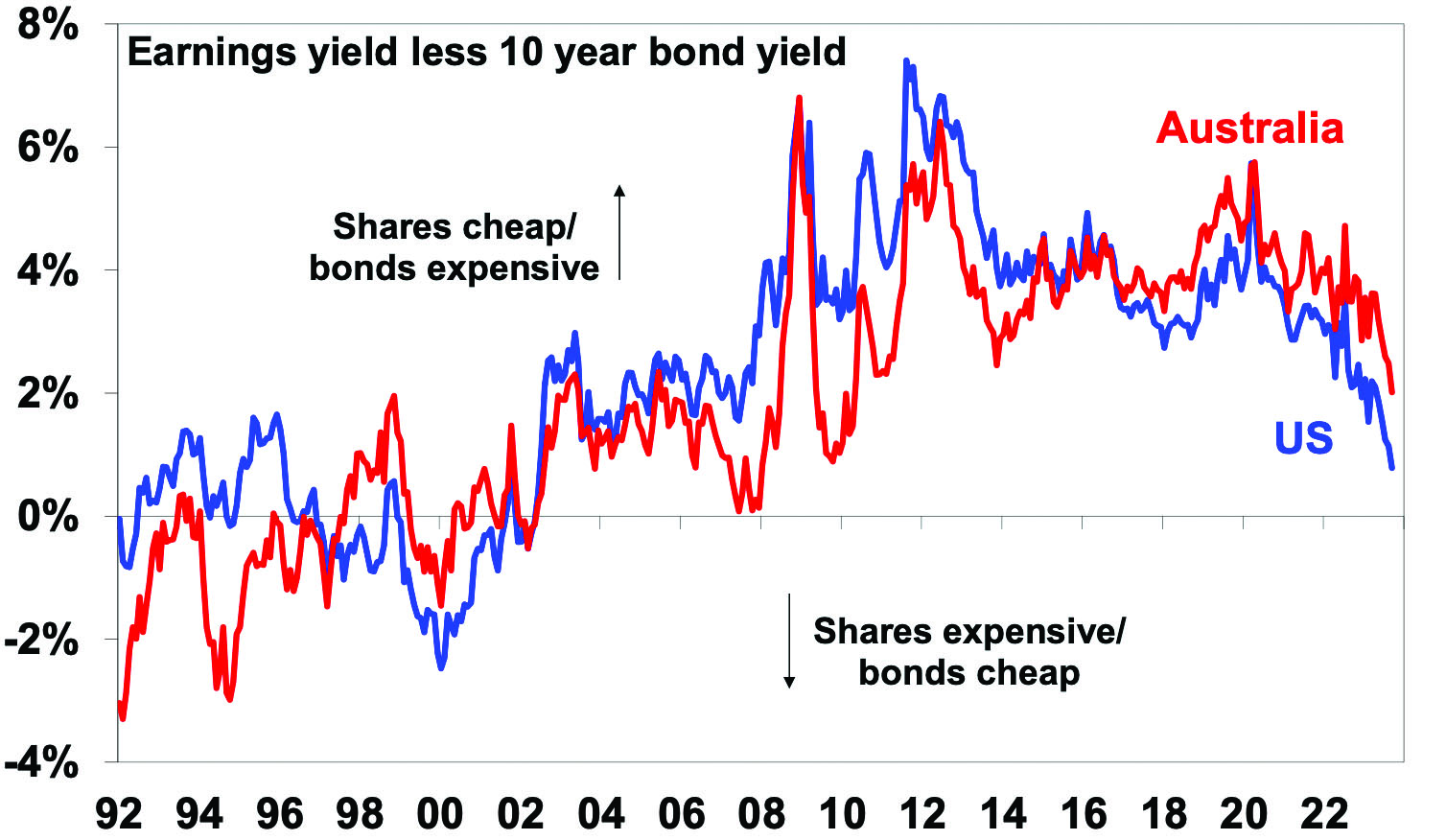

Shares – PE ratios for shares point to a medium-term return potential of around 10% for Australian shares but just 5% for US shares (see the red lines on the PE charts earlier). Allowing for the rise in bond yields – by subtracting 10-year bond yields from the earnings yields (using forward earnings) – shows US and Australian shares now offer a reduced return premium over bonds of around 0.8% in the US and 2% in Australia. See the next chart. For the US this is the lowest risk premium over bonds since after the tech wreck whereas current uncertainties (around interest rates, recession risk & geopolitics) suggest the risk premium should ideally be higher. Fortunately, that for Australian shares is more attractive. But ideally bond yields need to fall to improve the prospects for shares. If we are right and inflation continues to fall over the year ahead, then this should allow lower bond yields and provide some support to shares. But in the near term the risk of a further correction in share markets led out of the US remains high reflecting the deterioration in US share valuations particularly for tech stocks which are very sensitive to bond yields.

Shares offering a lower risk premium over bonds

Source: Bloomberg, AMP Capital

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital September 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.