Provision Newsletter

Seven reasons why Australia should be able to avoid a recession

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

IntroductionEconomic and financial commentary has been particularly gloomy of late, with talk of a “dire”, “grim”, “bleak”, “perilous” and “confronting” outlook. The problems are well known: high inflation; particularly high and still rising energy prices; central banks aggressively raising interest rates; a high risk of recession globally;

Read MoreDr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

Economic and financial commentary has been particularly gloomy of late, with talk of a “dire”, “grim”, “bleak”, “perilous” and “confronting” outlook. The problems are well known: high inflation; particularly high and still rising energy prices; central banks aggressively raising interest rates; a high risk of recession globally; the war in Ukraine, along with other geopolitical risks; and the downturn in China. One could be forgiven for thinking that recession in Australia is inevitable in the next year.

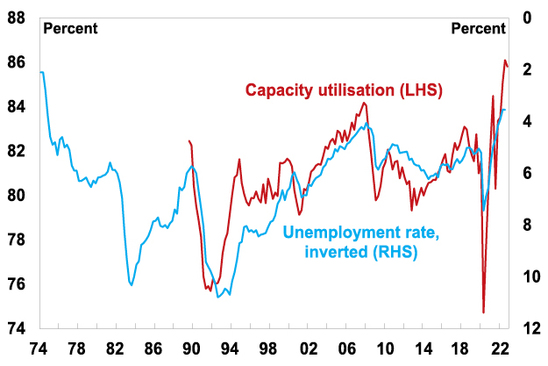

Returning inflation to the 2-3% target is of utmost importance as the 1970s experience highlights that failure to do so will lead to even worse economic conditions and a continuing rough time in investment markets. And the surge in inflation is more than just supply constraints flowing from the pandemic, the war in Ukraine and floods, as demand is running well above supply in the Australian economy. This is evident in very high capacity utilisation rates and very low unemployment (see the next chart).

Australian spare capacity is low

Source: ABS, NAB, AMP

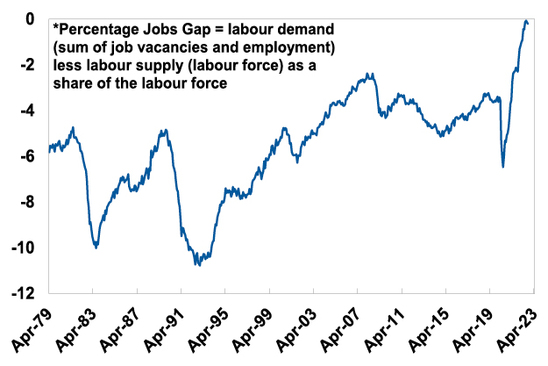

For the labour market its also evident in a high ratio of job vacancies to unemployment. This has meant that the “jobs gap” in Australia (defined as labour demand (as measured by job vacancies plus employment) less labour supply (or the labour force) as a share of the labour force) which has closed to around zero for the first time in over 40 years (see the next two chart). The longer the very tight labour market remains, the greater the chance that wages growth will surge will in excess of the three point something that is consistent with inflation in the 2-3% target range.

Australian Jobs Gap*

Source: ABS, AMP

To bring demand in the economy back into line with supply some economic slowdown is required to help get inflation back down. Hence the RBA has been raising interest rates.

With households most vulnerable to higher interest rates due to high levels of household debt and the double whammy from falling real wages, consumer spending is set to slow sharply. And RBA Governor Lowe has noted on several occasions that “we are travelling along a narrow path here” in terms of being able to return inflation to target and avoid a recession. However, it’s not inevitable that Australia will slide into recession. Assuming there is no further significant flare up in geopolitical problems (such as a war over Taiwan), this note looks at seven reasons why Australian should be able to avoid a recession.

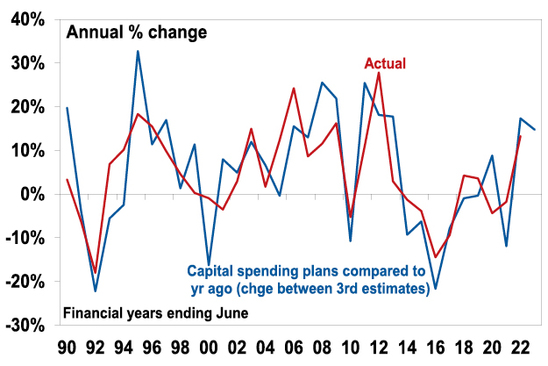

#1 The business investment outlook is reasonably solid

Business investment plans for the year ahead remain strong. The ABS capital spending intentions survey is up about 15% on a year ago. It’s likely this partly reflects the higher costs of investing, but it’s also consistent with high levels of capacity utilisation, reasonable business conditions and confidence, and some easing in supply chain pressures. Real business investment is expected to grow by around 5% over the year ahead.

Actual and expected capital expenditure

Source: ABS, AMP

#2 There is a large pipeline of home building work

From their high last year, approvals to build new homes in Australia have fallen about 25% reflecting the end of the HomeBuilder grant and rising interest rates. While this points to a downturn in home building, its likely to be cushioned because there is a large pipeline of work yet to be completed with home completions yet to catch up to the surge in home building approvals through the pandemic (see red circled area in the next chart). This has been due to poor weather and shortages of labour and building materials. The large pipeline of work yet to be done will likely provide a floor for home building, preventing a plunge in dwelling investment that would normally flow from a 25% fall in approvals.

Residential approvals and completions

Source: Macrobond, AMP

#3 High energy prices are boosting national income

While the surge in energy prices is a huge hit to household budgets, its providing a big boost to national income via the earnings of energy companies. This is evident in strong trade surpluses and contributed to a $48bn improvement in the budget deficit last financial year and $42bn this financial year. This in turn is helping reduce the budget deficit and providing greater fiscal flexibility for the Australian Government.

#4 The $A will plunge if global recession leads to a sharp fall in commodity prices

So far this year the $A is down 11% against the $US but is unchanged on a trade weighted basis, ie against an average of currencies (as other currencies have fallen more against the $US than the $A has). But if global economic conditions collapse leading to a sharp fall in Australian commodity prices and hence our export earnings (which would push down inflation globally and in Australia) it’s likely that the $A will fall sharply. This in turn will help support the Australian economy by making our exports more competitive as it did in the Asian crisis, tech wreck and the GFC.

Alternatively, Chinese growth, after surprising on the downside this year could surprise on the upside next year. A key drag this year has been its zero Covid policy. But there are several signs that its heading towards an easing of it: with the People’s Daily running an article downplaying long Covid; a relaxation of PCR test requirements in some regions; Pfizer’s vaccine being made available to foreigners in China; and some regions building new makeshift hospitals. Its looking likely that the easing could come early next year. If so, this could result in a sharp rebound in Chinese growth as the stimulus measures of the last year would then be allowed to work. This in turn would boost global growth and benefit Australia.

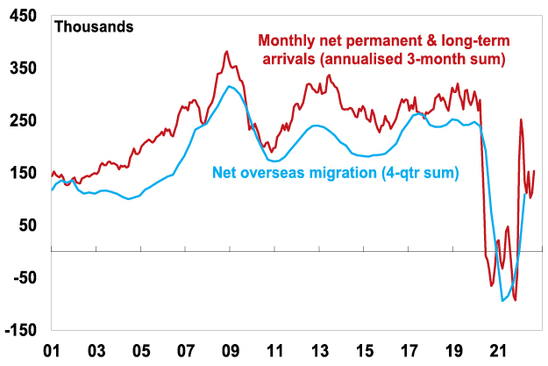

#5 Immigration is rebounding rapidly

A surge in new visas for arrivals as the backlog is worked through and in monthly data for net permanent and long-term arrivals point to a rebound in immigration levels. Consistent with this the Budget is projecting net immigration of 235,00 from this financial year consistent with pre-pandemic levels. This follows negative net immigration in 2020-21. The surge in immigration will help ease the labour shortage and tight jobs market evident in the first two charts in this note. Which in turn will help head off a surge in wages growth to levels well beyond those consistent with the inflation target.

Australian net immigration on the rise again

Source: ABS, AMP

#6 Inflation may be less of a problem in Australia

It’s all very well to say the economy is resilient, but that may just mean that the RBA will have to raise rates by more than otherwise to slow demand enough to get inflation down. In other words, the previous considerations are necessary to help avoid recession but are not sufficient. So this brings us to inflation and here there are reasons for optimism that the RBA won’t have to raise rates too much further (& not to the 4% plus that the money market is assuming but which would most likely tip us into recession):

-

First, Australian wages growth is far lower than in other countries.

-

Second, at least our energy prices have not been doubling or more, unlike in Europe.

-

Third, longer-term inflation expectations are still consistent with the inflation target which should make inflation a lot easier to bring under control than it was in the 1980s when high inflation was entrenched.

-

Fourth, while the Australian labour market is very tight, risking a wages blowout, this is in large part due to the absence of immigrants. Unlike in other countries labour force participation is above pre-pandemic levels and the return of immigrants will ease worker shortages.

-

Fifth, the simultaneous monetary tightening by central banks risks a sharp slowing in global growth and inflationary pressures that Australia will benefit from, reducing the amount the RBA will need to tighten by.

-

Finally, US upstream price pressure are slowing which should benefit Australia which is following US inflation with a six-month lag.

#7 The RBA has opted to move into the slow lane

Much will come down to how aggressive the RBA gets in raising rates. It has noted that it “will do what is necessary to” return inflation to target. But it’s also noted that its seeking to do this “while keeping the economy on an even keel.” After an initial run of rapid rate rises that returned the cash rate to more normal levels it has since slowed the pace down to better assess their lagged impact, allow for the global downturn, and hopefully strike “the right balance between doing too much and too little.” In motoring parlance “speeding kills” – the initial acceleration in rates was necessary to catch up to inflation but to continue at that pace would run the risk of a serious accident that tips us unnecessarily into recession.

Concluding comment

Some may wonder why I haven’t noted the strong jobs market as a reason why we should be able to avoid recession – the reason is because jobs are a lagging indicator. They were strong prior to the early 1990s recession too! Some may also argue that many households are protected by large mortgage and saving buffers – but many households aren’t, so I decided to not rely on that one too. But the key is that there are enough other reasons why, although economic growth is likely to slow sharply from 3% this year to around 1.5% next year, we should be able to avoid a recession.

Source: AMP Capital November 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

The October 2022-23 Australian Budget

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP CapitalDiana Mousina – Senior Economist, AMP Capital

IntroductionThe Government has implemented its election policies and expects lower budget deficits this year and next thanks to another revenue windfall and various savings. Future years show a significant

Read More– balancing a revenue windfall, election promises, structural spending demands & inflation pressures

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Diana Mousina – Senior Economist, AMP Capital

Introduction

The Government has implemented its election policies and expects lower budget deficits this year and next thanks to another revenue windfall and various savings. Future years show a significant deterioration though as structural spending pressures, higher interest rates and lower productivity growth impact. As the Treasurer foreshadowed, this is largely a “bread and butter” budget though with significant reform left for next year’s budget.

Key budget measures

Key measures in the Budget mainly reflect election promises:

-

Increasing the childcare subsidy rate and expanding eligibility.

-

Extending paid parental leave to 6 months with widened eligibility.

-

More for Medicare, aged care, health, the NDIS and defence.

-

Cheaper PBS drugs by cutting the co-payment to $30 from $42.50.

-

Tax incentives for electric cars.

-

Reinvigorating workplace bargaining to lift wages in low-income jobs.

-

Increased spending on TAFE and more university places.

-

Increased infrastructure spending although this had already largely been budgeted with some funds “re-profiled”.

-

Increased aid for the Pacific and South-East Asian countries.

-

Various housing support measures – setting up a new Housing Accord to build 1 million new homes over 5 years, a Help to Buy equity scheme for 10,000 first home buyers, super concessions for downsizers over 55, the establishment of a National Housing Supply and Affordability Council, $350m in Federal Funding to help incentivise institutional (including super fund) investment in delivering an extra 10,000 affordable homes.

-

The start-up of various “off budget funds” – a $10bn fund to build 30,000 affordable homes, a $20bn fund to boost renewable electricity infrastructure and a $15bn National Reconstruction Fund.

Budget savings include the following:

-

A cut in public sector spending on consultants, travel & labour hire.

-

Cuts to regional infrastructure funds & community grants.

-

A crackdown on tax avoidance.

-

Increased tax on multinationals.

The Government has deferred any decision on the Stage 3 2024 tax cuts.

Economic assumptions

Since the March Budget there has been a significant deterioration in the outlook reflecting high price and cost pressures (not helped by the war in Ukraine and natural disasters), aggressive monetary tightening in response and falling real wages. As a result, the Government has revised up its inflation forecasts to allow for a slower decline through next year (although it still sees a peak this year at 7.75%), downgraded its GDP growth forecast for 2023-24 to just 1.5% mainly due to weaker consumer spending and revised up its unemployment forecast for mid 2024 to 4.5%. We are a bit more optimistic on the speed with which inflation will fall next year.

The Federal Government now sees net immigration rising to 235,000 this financial year and continuing at this trend, which is back to pre-pandemic levels. The Government pushed out its $US55/tonne iron ore price assumption to March quarter 2023. With iron ore now around $US95/tonne, it remains a source of revenue upside.

Economic assumptions

|

|

|

2021-22 |

2022-23 |

2023-24 |

2024-25 |

2025-26 |

|

Real GDP |

Govt |

3.9 |

3.25 |

1.5 |

2.25 |

2.5 |

|

% year |

AMP |

|

3.4 |

1.6 |

2.5 |

2.5 |

|

Inflation |

Govt |

6.1 |

5.75 |

3.5 |

2.5 |

2.5 |

|

% to June |

AMP |

|

5.6 |

2.8 |

2.7 |

2.5 |

|

Wages, |

Govt |

2.6 |

3.75 |

3.75 |

3.25 |

3.5 |

|

% to June |

AMP |

|

3.6 |

3.5 |

3.2 |

3.25 |

|

Unemp Rate |

Govt |

3.8 |

3.75 |

4.5 |

4.5 |

4.25 |

|

% June |

AMP |

|

4.0 |

4.2 |

4.2 |

4.25 |

Source: Australian Treasury, AMP

Budget deficit projections

The Government’s revised budget projections are shown in the next table. Despite increased spending, mostly associated with election promises, the deficit projections are lower for this year and next than in March. This is mostly due to another budget windfall from higher commodity prices, lower unemployment for now & higher inflation – which boosts revenue relative to spending (see the line called “parameter changes”). This was the main driver of the 2021-22 deficit coming in at $32bn rather than the $80bn back in March. It’s reduced the deficit by $42.2bn this year and $11.7bn next. Also helping are that any new spending measures are largely offset by budget savings such that “new stimulus” this year is just $1.1bn and next year there is no new stimulus. As a result, the expected deficit for this year has fallen to $36.9bn and for next year to $44bn (from $78bn and $56.5bn back in March). This lack of extra significant stimulus when inflation pressures are strongest is economically responsible.

However, from 2024-25 onwards the projections for the budget deficit have worsened relative to March reflecting a combination of an assumption that commodity prices revert to more “realistic” levels, a lower long run productivity growth assumption of 1.2%pa (down from 1.5%pa) which lowers growth in the tax base and greater allowance for structural spending pressures – on the NDIS, aged care, health, defence and interest costs, but mainly the NDIS.

Underlying cash budget balance projections

|

|

2021-22 |

2022-23 |

2023-24 |

2024-25 |

2025-26 |

|

Mar 21-22 Budget, $bn |

-79.8 |

-78.0 |

-56.5 |

-47.1 |

-43.1 |

|

Parameter chgs, $bn |

|

42.2 |

11.7 |

-2.2 |

0.8 |

|

New stimulus, $bn |

|

-1.1 |

0.7 |

-2.0 |

-7.4 |

|

Projected budget,$bn |

-32.0 |

-36.9 |

-44.0 |

-51.3 |

-49.6 |

|

% GDP |

-1.4 |

-1.5 |

-1.8 |

-2.0 |

-1.8 |

Source: Australian Treasury, AMP

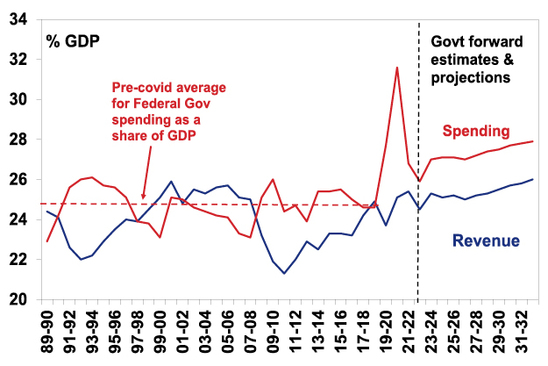

As in the last few budgets, projections for spending as a share of GDP have shifted higher again & are now expected to average 27.1% of GDP over the next three years before rising to 28% of GDP by 2023-33, up from the pre-covid average of 24.8%. This reflects structural pressure from health, aged care, the NDIS, defence and interest costs. Revenue is still assumed to rise with a growing economy – even with the Stage 3 tax cuts – but is no longer assumed to be enough to close the gap with spending.

Federal Government spending and revenue

Source: Australian Treasury, AMP

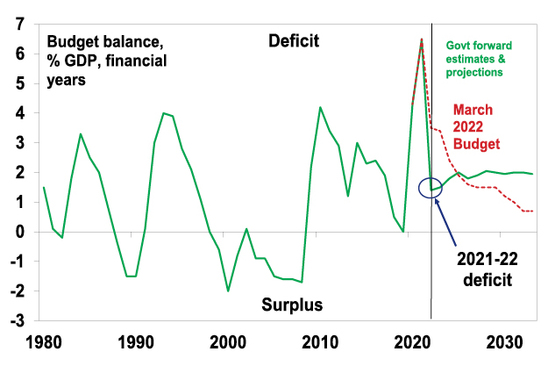

So the budget deficit is now projected to be stuck at 2% into next decade.

Australian Federal budget deficit

Source: Australian Treasury, AMP

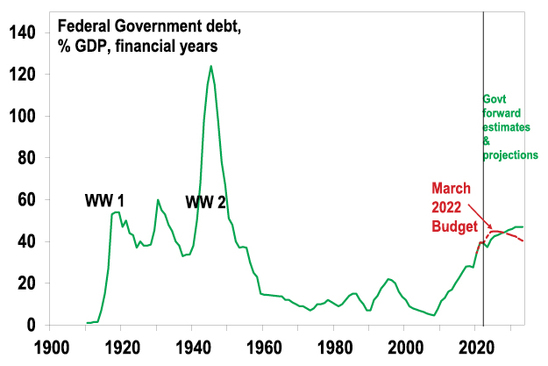

Due to the lower budget deficit in the next two years and higher nominal GDP, gross public debt is now projected to be lower as a share of GDP than previously projected for the next four years. However, the $1trillion level is still expected to be reached next year. And the worse medium term deficit projections now see public debt looking worse into next decade.

Australian Federal gross debt

Source: RBA, Australian Treasury, AMP

Assessment

Winners include: parents; students; medicine users; patients; electric car buyers; NBN users; aged care residents; pensioners; new home buyers; skilled migrants; neighbouring countries; electric car buyers; and the environment. But unlike in the March Budget there are more losers this time including: multinationals; tax avoiders; foreign investors; Federal law breakers; and consultants, contractors & travel agents to the public sector.

The Budget has a bunch of things to commend it:

-

For this year and next it has largely saved the revenue windfall, resulting in a decline in the deficit to $36.9bn for this year and to $44bn next year (from the $78bn and $56.5bn expected in March). Because there is no significant new stimulus this year and next fiscal policy won’t add to inflation when it is highest and make the RBA’s job harder. As such there is no Trussonomics here!

-

Spending measures are aimed at boosting workforce participation (child care & parental leave) and productivity (infrastructure and skills measures) which may help boost the supply side of the economy.

-

There has been a realistic attempt to highlight the structural pressure on the budget, the economic assumptions look reasonable and public debt remains low compared to other comparable countries. This should see the Government retain its triple A credit rating.

- Commodity price assumptions remain well below current levels and so could be a source of downside surprise for the deficit.

-

The new Government is focussing more on boosting the supply of housing to help improve affordability, rather than just on demand which only makes the problem worse. The challenge is that much of the supply boost begin until from 2024 and in the meantime underlying demand for housing is already rising with immigration ramping up.

However, the Budget presents a significant long-term challenge with yet another ramp up in structural spending (reflecting increasing demands on the public sector) with a little in the way of major spending offsets and a continuing reliance on rising revenue to at least stop the situation worsening. As such it still leaves significant deficits in place for the next decade at least, leaves the budget vulnerable should anything come along to curtail the commodity boom and runs the risk that the ever expanding government share of GDP further slows productivity growth over the medium term. At some point tough decisions are required to cap spending growth or further raise tax revenue, hopefully in a way that does not crimp productivity growth. This remains an issue for the next budget.

Implications for the RBA

The good news is that the Budget, with its lower deficits this year and next, won’t add to inflationary pressure in the near term and so won’t add to RBA rate hikes. We expect another 0.25% rate hike next week and the cash rate to peak at 2.85% with a risk case of 3.1%.

Implications for Australian assets

Cash and term deposits – cash returns remain low but are improving thanks to RBA rate hikes.

Bonds – ongoing budget deficits add to upwards pressure on bond yields, but at least they have been lowered in the near term so there should be no new upwards pressure on bond yields from this source. Longer term the budget deficits present more of a challenge though.

Shares – the budget is positive for childcare and construction companies but beyond that there is not really a lot in it for the share market.

Property – the confirmation of more homebuyer schemes and more immigrants offset by long term housing supply measures are unlikely to alter the dominant negative impact of rising mortgage rates in driving a cyclical downturn in home prices.

The $A – the Budget is unlikely to change the direction for the $A.

Source: AMP Capital October 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Seven things for investors to keep in mind in rough times like these

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

IntroductionSuccessful investing can be really hard in times like the present. Falls in share markets and other assets are stressful as no one likes to see their wealth decline and the natural inclination is to retreat to safety. From their highs last year or early this year

Read MoreDr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

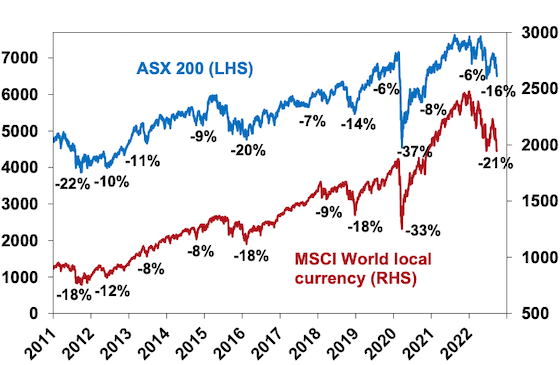

Successful investing can be really hard in times like the present. Falls in share markets and other assets are stressful as no one likes to see their wealth decline and the natural inclination is to retreat to safety. From their highs last year or early this year to recent lows US and global shares have fallen about 25%. Australian shares have held up better, remaining up from their June low at which point they had had a fall of 16% from their high in August last year, but they remain vulnerable to the lead from global shares. While shares have managed to find technical support in recent days and could bounce further given high levels of negative sentiment, the near-term downside risks for shares remain high, reflecting the same array of macro risks that have been weighing on them all year, notably:

-

high inflation and ultra-hawkish global central banks;

- the $US trending up on safe haven demand and Fed rate hikes risking a financial accident – with mayhem in the UK adding to fears of crisis;

-

an escalation in the Ukraine war, along with other geopolitical risks;

-

high and still rising recession risks; and

-

downwards revisions to earnings ex

-

pectations flowing from all this.

We had a detailed look at the issues a few weeks ago along with signs of light at the end of the tunnel (see here), but I will be the first to admit my crystal ball gets even hazier at times like the present. As always, the turmoil in markets is being met with lots of prognostication. Some of which is enlightening but much is noise. But to borrow one of my favourite quotes that Mark Twain is said to have said “history doesn’t repeat but it rhymes”. While the weakness we are going through differs in detail from rough patches in the past, basic investment principles still apply. It’s hard to say anything new other than to reiterate them. So, apologies if you have seen “seven things for investors to keep in mind” from me before, but at times like this they are worth revisiting.

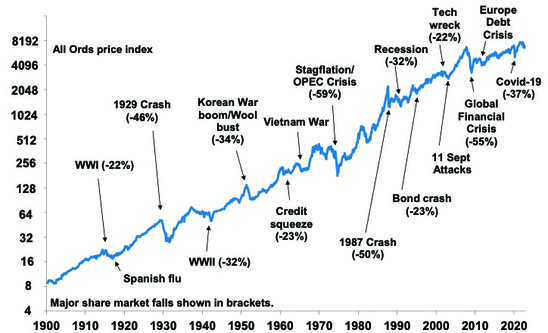

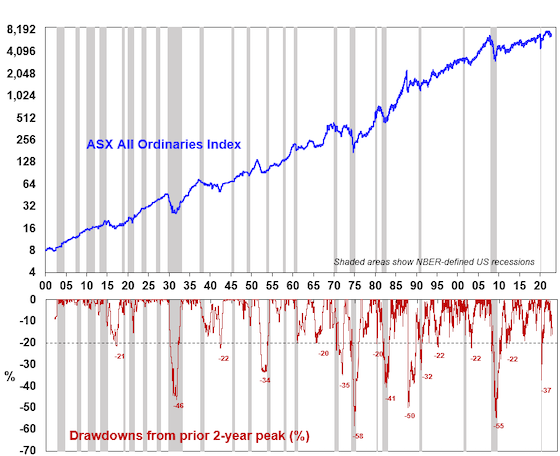

#1 Share market falls are normal – the key is to make the most of the power of compound interest

First, while they all have different triggers and unfold differently, periodic share market falls are healthy and normal. Sometimes they are just 5% to 20% corrections, but every so often they can be deep bear markets with falls up to around 50% as in the GFC. But while share market pullbacks can be painful, it’s the way the share market has always been, so they are nothing new. As can be seen in the next chart shares climb a wall of worry over many years but with numerous events dragging them down periodically, but with the long-term rising trend ultimately resuming.

Australian shares have climbed a wall of worry

Source: ASX, AMP

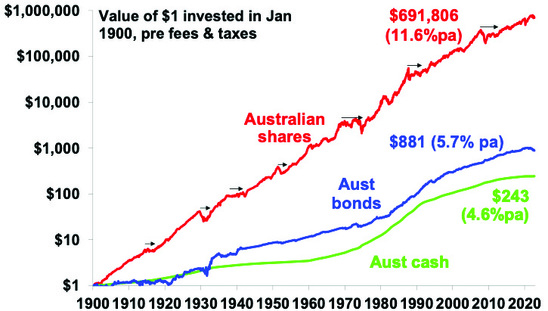

Bouts of volatility are the price we pay for the higher longer-term returns from shares compared to other assets like cash and bonds. The next chart shows the value of $1 invested in various Australian assets in 1900 allowing for the reinvestment of dividends and interest along the way. That $1 would have grown to $243 if invested in cash, to $881 if invested in bonds and to $691,806 if invested in shares. While the average return since 1900 is only double that in shares relative to bonds, the huge difference between the two at the end owes to the impact of compounding returns on top of returns. So, if we want to grow our wealth we need an exposure to growth assets like shares to make the most of the power of compound interest, but with that comes rough patches every so often.

Shares versus bonds & cash over very long term – Australia

Data shown is prior to any fees and taxes. Source: Bloomberg, ASX, RBA, AMP

#2 The key is not to get thrown off by cycles – selling shares after a fall turns a paper loss into a real loss

When shares are falling sharply its naturally tempting to sell. At least it may then be easier to sleep at night. But selling shares or switching to a more conservative investment strategy whenever shares suffer a cyclical setback just turns a paper loss into a real loss with no hope of recovering.

#3 Timing is hard

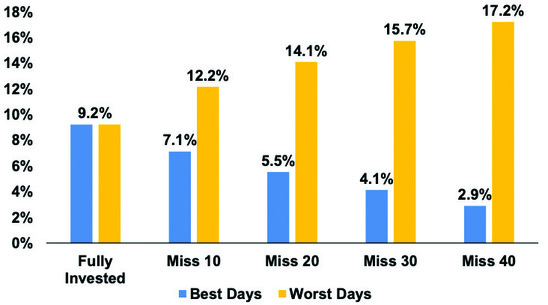

Of course, you may be thinking “but I will reinvest once uncertainty is removed”. But the risk is you don’t feel confident to get back in until long after the market has fully recovered, which may be well above the level you sold out at. Trying to time the market is very difficult. A good way to demonstrate this is with a comparison of returns if an investor is fully invested in shares versus missing out on the best (or worst) days. The next chart shows that if you were fully invested in Australian shares from January 1995, you would have returned 9.2%pa (including dividends but not allowing for franking credits, tax and fees).

Missing the best days and the worst days

Source: Bloomberg, AMP

If by trying to time the market you avoided the 10 worst days (yellow bars), you would have boosted your return to 12.2% pa. If you avoided the 40 worst days, it would have been boosted to 17.2% pa. Fantastic! But this is very hard to do, and many investors only get out after the bad returns have occurred, just in time to miss some of the best days. For example, if by trying to time the market you miss the 10 best days (blue bars), the return falls to 7.1% pa. If you miss the 40 best days, it drops to just 2.9% pa. Hence the old cliché that “it’s time in that matters, not timing”.

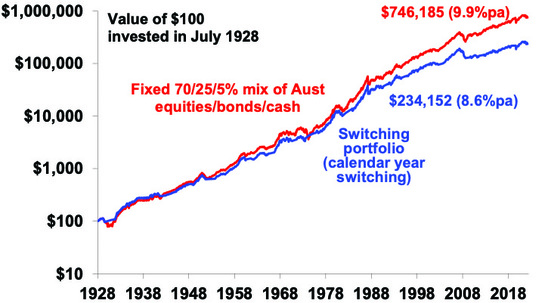

The following chart shows the difficulties of short-term timing in another way. It shows the cumulative return of two portfolios.

-

A fixed balanced mix of 70% Australian equities, 25% bonds, 5% cash;

-

A “switching portfolio” which starts off with the above but moves 100% into cash after any negative calendar year in the balanced portfolio and doesn’t move back until after the balanced portfolio has a calendar year of positive returns. We assumed a two-month lag.

Comparison of constant strategy versus switching to cash after bad times

Source: ASX, Bloomberg, AMP Capital

Over the long run the switching portfolio produces an average return of 8.6% pa versus 9.9%pa for the balanced mix. From a $100 investment in 1928 the switching portfolio would have grown to $234,152 by September but the constant mix would have increased to $746,185.

The best way to guard against selling on the basis of emotion after weakness is to adopt a well thought out, long-term strategy and stick to it.

#4 Share market pullbacks provide opportunities

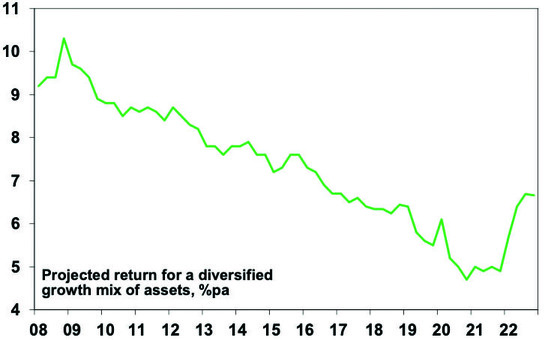

When shares and all assets fall in price, they’re cheaper and offer higher long-term return prospects. As a result of the fall in share and bond prices (and the resultant decline in PEs and rise in dividends yields and bond yields) our estimated medium term return projections for a diversified growth mix of assets has improved from around 4.9%pa to around 6.7%pa. So, the key is to look for opportunities’ pullbacks provide. It’s impossible to time the bottom but one way to do it is to “average in” over time.

Projected medium term returns

Source: AMP

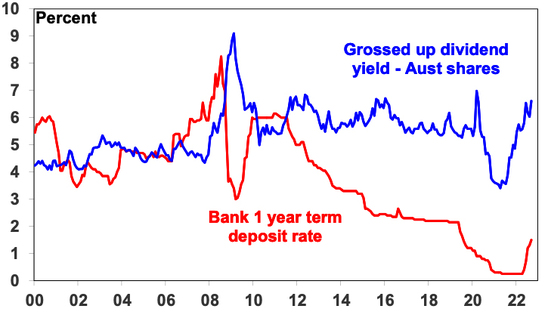

#5 Australian shares offer an attractive dividend yield

This is particularly so compared to bank deposits. Companies don’t like to cut their dividends, so the income flow you are receiving from a well-diversified portfolio of shares is likely to remain attractive, particularly against bank deposits even though deposit rates are slowing rising.

Aust shares still offer an attractive yield versus bank deposits

Source: RBA, Bloomberg, AMP

#6 Shares invariably bottom with maximum bearishness

Shares and other related assets often bottom at the point of maximum bearishness, ie, just when you and everyone else feel most negative towards them. This is when investors have lots of cash on the sidelines which provides fuel for an eventual rebound. This is the point of maximum opportunity. This is obvious in a way because shares could hardly bottom when everyone is already bullish because there would be no one to buy. The problem is that it’s hard for most people to commit to buying shares when there is so much gloom around. And, of course, investor sentiment could still get more negative in the short term before it bottoms.

#7 Turn down the noise

At times like this, negative news reaches fever pitch. Talk of billions wiped off share markets and warnings of disaster help sell copy and generate clicks & views. But we are rarely told of the billions that market rebounds and the rising long-term trend in share prices adds to the share market. Moreover, they provide no perspective and only add to the sense of panic. All of this makes it harder to stick to an appropriate long-term strategy let alone see the opportunities that are thrown up. So best to turn down the noise on all the negative news flow (and watch Elvis films).

Source: AMP Capital October 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

The perils of forecasting in investing – three things for investors to consider

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

IntroductionThe latest client note by Howard Marks, the co-founder and co-chair of Oaktree Capital, an alternative investment manager focussing on distressed debt, on The Illusion of Knowledge about the futility of forecasting to drive investment decisions, inspired me to revisit what I had already written on this

Read MoreDr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

The latest client note by Howard Marks, the co-founder and co-chair of Oaktree Capital, an alternative investment manager focussing on distressed debt, on The Illusion of Knowledge about the futility of forecasting to drive investment decisions, inspired me to revisit what I had already written on this subject.i Particularly so given the extreme moves in economic activity, inflation and interest rates associated with the pandemic and its aftermath, along with increasing geopolitical issues, all at a time of increasing access to information, and opinion via social media, and the flow on of all this to investment markets.

I am regularly called on to provide forecasts for economic and investment variables like growth, interest rates, currencies and shares. These usually come in the form of point forecasts as to where the variable will be in, say, a year’s time or its rate of return. Such point forecasts are part & parcel of the investment industry. In fact, forecasts – from the environment to economics to politics to coronavirus – have become part of everyday life.

Economic and investment forecasts are useful as a means of communicating a view, as an input to the construction of budgets and as a base case against which to assess risks and formulate economic policy. But relying too much on precise forecasts can be dangerous. This was demonstrated through the pandemic and now with the surge in inflation globally and rise of geopolitical uncertainty, but it’s nothing new.

If forecasting was easy you wouldn’t be reading this…

…and I wouldn’t have written it! We would be very rich and sipping champagne in the south of France. My first manager drummed it into me that “forecasting is difficult because it concerns the future”. The difficulty of getting economic forecast right is reflected in the long list of jokes and quotes about economists and forecasters. Here’s some:

-

Three economists went target shooting. The first missed by a metre to the right, the second missed by a metre to the left and the third exclaimed “we got it!”.

-

Economists exist to make weather forecasters & astrologers look good. Maybe epidemiologists fall in there too now.

-

An economist is a trained professional paid to guess wrong about the economy.

-

An economist will know tomorrow why the things she or he predicted yesterday didn’t happen.

-

Economic forecasting is like driving blindfolded with instruction from a person looking out the rear window.

-

Economics is the only field in which two people can share a Nobel Prize for saying the complete opposite.

-

For every economist there exists an equal and opposite economist.

-

Economists have predicted six of the last two recessions.

-

There are two classes of forecasters: those who don’t know and those who don’t know they don’t know (J.K. Galbraith).

-

Forecasters create the mirage the future is knowable (Peter Bernstein).

-

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so (Mark Twain).

Hit and miss – particularly around dislocations

Surveys of economic forecasts are regularly compiled and published. It is well known that when the consensus (or average) forecast is compared to the actual outcome, it is often wide of the mark. This is particularly so when there has been a major change in direction (or dislocation) for the variable being forecast – such as around events like the tech wreck in the early 2000s, the GFC and the recent surge in inflation. So just when you rely most on forecasts can be when they get it most wrong. This applies not only to economists’ forecasts for economic variables, but also to share analysts’ forecasts for company profits and to most forecasts across most disciplines. Where precise linear relationships apply – where A = B, eg, in predicting the date and time of the next eclipse – forecasting is easy. But where relationships can be non-linear and complex as in economics, investing and in most things people like to forecast – where a slight shift in the balance can result in A = B or C or ? – forecasting is far more difficult.

And of course, the bigger the call, invariably the bigger the miss.ii There are numerous examples of gurus using grand economic, demographic or financial theories – usually resulting in forecasts of “new eras” or “great depressions” or with assessments like “too much debt will cause an implosion”, “house or share prices are too high and are guaranteed to crash” or “the Eurozone will break up” – who may get their time in the sun but who also usually spend years before, or after, losing money. For example, the gurus who foresaw a “new era” in the late 1990s – with books like Dow 36,000 – looked crazy in the early 2000’s tech wreck. And many of those who did get the tech wreck or GFC “right” were bearish for years before and would have lost their fortune if they had shorted shares when they first got bearish.

Grand prognostications of doom can be particularly alluring, and wrong. Calls that the world is about to bump into some physical limit, causing some sort of “great disruption” (famine, economic catastrophe!), have been made with amusing regularity over the last two hundred years: Thomas Malthus; Paul Ehrlich’s The Population Bomb of 1968; the Club of Rome report on The Limits to Growth in 1972; and the “peak oil” fanatics who have been telling us for decades that global oil production will soon peak and when it does the world will be plunged into chaos. Such Malthusian analyses underestimate resources, the role of price increases in driving change and human ingenuity in facilitating it. (Hopefully, worst case predictions of a “climate catastrophe” will prove wrong for similar reasons!)

And when you’re reading books like those from Harry S Dent about The Great Depression Ahead (2009), etc, all of which had disaster happening well before now, just recall there has been a long list of prognostications for a great depression, often linked to a debt-related implosion, the bulk of which turned out to be wrong. Amongst my favourites are Ravi Batra’s The Great Depression of 1990 – well, that didn’t happen so it was just delayed to The Crash of the Millennium that foresaw an inflationary depression, which didn’t happen either. Google “the coming depression” and you’ll find 370 million search results (up from 72.3 million five years ago)!

The psychology of forecasting

Forecasts need to be treated with care for several reasons:

-

Forecasters, like everyone, suffer from psychological biases: the tendency to assume the current state of the world will continue; the tendency to look mostly for confirming evidence; the tendency to only slowly adjust forecasts to new information; and excessive confidence in their ability to forecast accurately. As Warren Buffett has said “forecasters usually tell us more of the forecaster than of the future”.

-

Point forecasts – eg, that the ASX200 will be 7000 by December 31 – convey no information about risks. They are conditional upon information available when the forecast is made. As new information appears, the forecast should change. Setting an investment strategy for the year based on forecasts at the start of the year and not adjusting for new information is a great way to lose money. This is particularly a problem if you only access forecasts periodically.

-

In investment management, what counts is the relative direction of one investment alternative versus others – precisely where they end up is of less consequence in the short term.

-

The difficulty in forecasting financial variables is made harder by the need to work out what is already factored into markets. Sometimes the market sets sensible share prices based on economic developments. At other times it is unstable, swinging from euphoria to pessimism. Trying to distil that into a precise forecast is not easy.

In the quest to be right, the danger is that clinging to a forecast will end up losing money. As Ned Davis has pointed out, for investors the key is to make money, not to be right with some forecast.

So why are forecasts treated with such reverence?

First, many see the world through the rear-view mirror where everything seems clear and obvious and so assume that the future must be easy to forecast too for anyone who has expertise. Second, and more fundamentally, people hate uncertainty and will try to remove it. So, precise quantified forecasts seem to provide a degree of certainty in an otherwise uncertain world. And if we don’t have the expertise, the experts must know. And finally, prognostications of doom can be alluring as investors suffer from a behavioural trait known as “loss aversion” in that a loss in financial wealth is felt more keenly than the beneficial impact of the same sized gain. This leaves us more risk averse, and it also leaves us more predisposed to bad news stories as opposed to good. Flowing from this, prognosticators of gloom are more likely to be revered as “deep thinkers”.

What to do? Three things for investors to consider

If we simply relied on point forecasts for key investment market variables (like the share market, bond yields and the exchange rate) to set our investment strategy, I know it won’t be the best way to make money for our clients. By the same token, it’s not possible to avoid some sort of forecasting all together: investors who rely on charting are assuming that patterns in past asset price moves are a guide to the future; value investors are relying on implicit assumptions that things will mean revert over some time frame; and long-term investors in growth assets are assuming that economic progress will favour growth assets over the long term as they have historically. All of which, despite claims to the contrary, are some form of forecasting. So, what should one do? In my opinion, there are three things to consider in the light of issues raised in this note.

First, minimise the reliance on expert forecasts – particularly point forecasts and grand prognostications – when undertaking investment decisions. While point forecasts can help communicate a view, the real value in investment experts – the good ones at least – is to provide a better understanding of the issues around investing, a better understanding of what’s going on now and to put things in context so as to help avoid silly investment mistakes. While financial history does not repeat, it does rhyme and so in many cases we have seen a variant of what may be currently concerning the market before. This is particularly important in being able to turn down the noise and focus on a long-term investment strategy to meet your investment goals.

Second, invest for the long term. In the 1970s, Charles Ellis, a US investment professional, observed that for most of us investing is a loser’s game. A loser’s game is where bad play by the loser determines the victor. Amateur tennis is an example where the trick is to avoid stupid mistakes and win by not losing. The best way for most investors to avoid losing at investments is to invest for the long term. Get a long-term plan that suits your level of wealth, age, tolerance of volatility, etc, & stick to it.

Finally, if you are going to actively manage your investments, make sure you have a disciplined process. Ideally, this should rely on a wide range of indicators, such as: valuation measures (ie, whether markets are expensive or cheap); indicators that relate to where we are in the economic and profit cycle; measures of liquidity (or some guide to the flow of funds available to invest); measures of market sentiment (the crowd is often wrong); and technical readings based on historic price patterns. The key to having a disciplined process is to stick to it and let the “weight of indicators” filter the information that swirls around investment markets, so you are not distracted by the day-to-day soap opera engulfing them. Forecasting should not be central to your process. My preference is to focus on key themes as opposed to precise point forecasts.

Conclusion

It is tempting to believe that you or someone else can perfectly forecast the market. Getting markets right is hard enough and even then, there are plenty of investors who have been “right” on some market call but lost a bundle by executing too early or hanging on to it for too long. The key is to know where expert views can be of use, be humble and stick to a long-term investment strategy designed to attain your goals and, if you are going to actively manage your investments, have a disciplined process.

i See “Making money versus being right in the loser’s game”, Oliver’s Insights, September 2006 and “The Perils of forecasting and the need for a disciplined investment process”, Oliver’s Insights, May 2017.

ii Future Babble by Dan Gardner, Plume, 2011 is an excellent and entertaining read on the issues around forecasting.

Source: AMP Capital October 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

The RBA hikes rates by 0.25%

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

IntroductionThe RBA has increased its cash rate again but slowed the pace to 0.25% which took the cash rate to 2.6%. This was in line with our view and a slowing

Read MoreHere are five reasons why the RBA was right to slowdown and the top is near

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

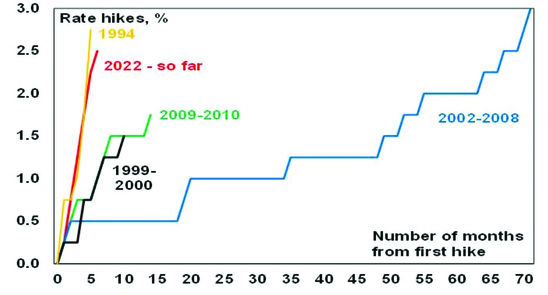

The RBA has increased its cash rate again but slowed the pace to 0.25% which took the cash rate to 2.6%. This was in line with our view and a slowing “at some point” had been flagged by the RBA. In justifying another hike, the RBA noted inflation is still too high and expected to rise further due to global factors and strong demand and that it’s important that medium term inflation expectations remain “well anchored”. But the 250 basis points in rate hikes over six months is still the fastest series of hikes since 1994, so it made sense to slow the pace down “as it assesses the outlook for inflation and growth”.

RBA hike cycles compared

Source: RBA, AMP

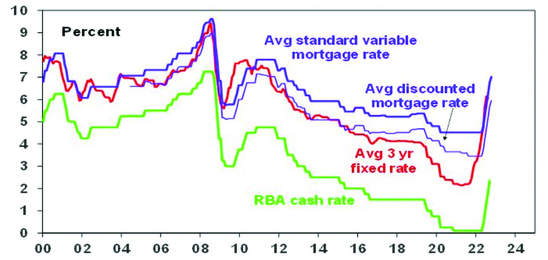

Of course the slowdown in rate hikes to a “business as usual” 0.25% move does not mean the RBA has finished hiking as it repeated that it will do “what is necessary” to get inflation to target and it still expects to raise rates further. Banks are likely to pass the hike on in full to variable rate customers which will take mortgage rates to their highest in ten years.

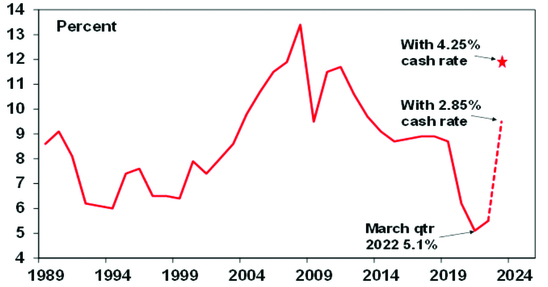

Australian interest rates on the rise

Source: RBA, Bloomberg, AMP

Five reasons why the RBA was right to slowdown and expectations for a 4% plus cash rate are too hawkish

Getting inflation back under control is critical as a rerun of the 1970s experience of high inflation will be disastrous. So the RBA has been right to sound tough and act aggressively. However, after the most aggressive run of rate hikes since 1994, the RBA was right to slow down the pace of hikes to better assess their impact and avoid overtightening. Here are five reasons why the RBA is likely to remain in the slow lane in the months ahead and why the cash rate won’t have to go as high as the 4% plus the money market has been factoring in.

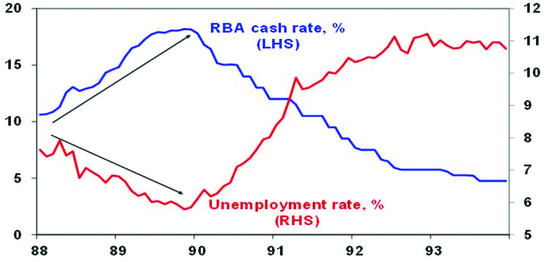

#1 Monetary policy impacts the economy with a lag.

This is because it takes 2-3 months for RBA rate hikes to impact actual variable rate mortgage payments and then several months before this impacts spending. There are then flow on effects to jobs and business investment with feedback impacts on household which can take up to a year. And this lag may have been lengthened by the rise in fixed rate lending around 2020-21 that saw it rise from 15% of total mortgages to around 40%. The lag was clearly evident in the late 1980s and early 1990s – see the next chart.

RBA rate hikes & unemployment in the late 1980s/early 1900s

Source: ABS, AMP

Unemployment kept falling through 1988 and 1989 – to 5.8% which was considered low at the time after it rose above 10% in the early 1980s – as the RBA progressively hiked rates to 18%. But by then it was too late as the impact of past rate hikes hit the economy hard in 1990 and it went into deep recession, with the RBA then having to rapidly reverse course as unemployment surged. Of course, things were different back then with very low debt & very high inflation expectations resulting in much higher interest rates than are needed today – but the lags are still relevant. To avoid overtightening as in 1989, the key is to slow down the pace of hikes to allow time for the lags to work – and this is what the RBA now appears to be.

#2 Many households will see significant mortgage stress, which will hit spending from later this year. The 2.75% in RBA rate hikes have already blown through the 2.5% interest rate serviceability buffer that applied up until last October and are close to bursting through the 3% buffer applying since then. While RBA analysis shows that just over one third of households with a variable rate mortgage will see no increase in their payments with a 3% rise in interest rates as they were already paying more than they need to they will still be worse off because they will be paying down their debt more slowly. But it also shows that more than a third of households with a mortgage will see a greater than 40% increase payments. This is about 1.3 million households and would cover those most likely to have to cut back their spending, ie new home owners often with a young family.

Looked at another way, a variable rate borrower on an existing $500,000 mortgage will see about $75 added to their monthly payment from today’s RBA hike which will take the total increase in monthly payments since April to $740 a month. That’s nearly $9,000 a year which is already a massive hit to household spending power. And there is roughly a quarter of mortgaged households with fixed rates who will see a three-fold increase in their payments when their fixed term expires over the next two years – many of whom are next year.

The surge in house prices, household debt levels and debt principal repayments as a share of household income to record levels over the last 30 years was made possible by falling interest rates to record lows which took household interest payments down to levels not seen over the past 45 years or so as a share of household income. A rise in the cash rate to 4% or more would push total mortgage repayments (ie, interest and principal) to record highs relative to household income.

Household interest payments relative to disposable income

Source: ABS, RBA, AMP

The combination of a household debt to income ratio nearly double US levels and greater sensitivity to interest rate changes (with 60% of mortgages on variable rates and 40% on short dated fixed rates compared to US borrowers on 30-year fixed rates) means that the household sector in Australia is far more vulnerable to interest rate changes than US households. This means that the RBA can afford to be less hawkish than the Fed.

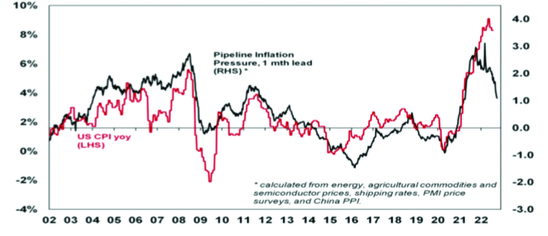

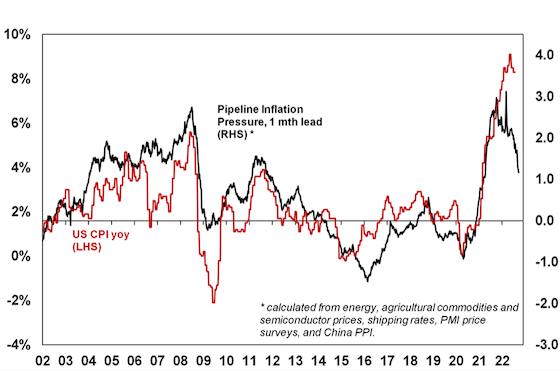

#3 Global inflationary pressures are continuing to ease. This is evident in global business surveys showing reduced delivery times and falling work backlogs, lower freight costs, lower metal and grain prices, and falling input and output prices.

As a result, our Pipeline Inflation Indicator is well down from its highs. Consistent with this US money supply which surged ahead of the US inflation spike is falling. Combined this points to downwards pressure on US inflation, which looks to have peaked. Australia appears to be following the US by about six months, pointing to a peak in inflation here later this year.

AMP Pipeline Inflation Indicator

Source: Bloomberg, AMP

Related to this, medium-term inflation expectations remain reasonably low suggesting that the task of central bankers should be a lot easier than in the 1970s and 1980s.

#4 Inflation pressures are less in Australia than elsewhere with inflation now around 7%yoy compared to over 8% in the US and 10% in Europe and wages growth about half US levels. So there is no need to match other central banks rate hikes.

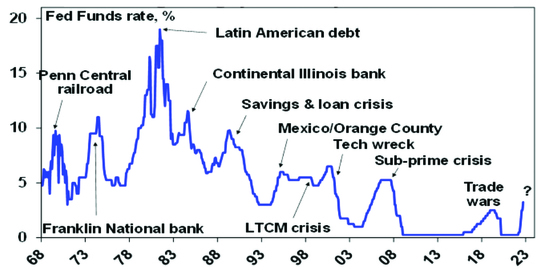

#5 Rising global recession risk. The 23% plunge in global share markets, falling commodity prices, central banks including the Fed willing to risk recession, the Fed’s record of tightening cycles ending in a crisis (next chart), the rising skittishness of financial markets, the deteriorating global growth outlook and domestically very low consumer confidence and rapidly weakening housing indicators warn of much weaker conditions ahead which will hit jobs & drive weaker inflation. Aggressively tightening into all this without pausing for breath risks knocking the Australian economy into a recession we don’t have to have.

Fed tightening cycles usually end in a circle

Source: Bloomberg, AMP

Concluding comment

Given the need to assess the lagged impact of rate hikes and the rising risk of recession globally the RBA was right to break from the hawkish global central bank consensus and slow down the pace of hikes. We see another 0.25% rate hike next month taking the cash rate to 2.85% which we still expect will be the peak in the cash rate, albeit the risk is on the upside to 3.1%. We still see rates falling late next year.

Source: AMP Capital October 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Shares sliding again – what’s driving it and is there any light at the end of the tunnel?

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

IntroductionInvestors could be forgiven for looking back on the pandemic years of 2020 and 2021 with fond memories – because after the initial shock in February-March 2020 it was a period of strong returns and relative calm in investment markets. This year has been anything but. After

Read MoreDr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

Investors could be forgiven for looking back on the pandemic years of 2020 and 2021 with fond memories – because after the initial shock in February-March 2020 it was a period of strong returns and relative calm in investment markets. This year has been anything but. After falling sharply into mid-June (at which point US shares had fallen 24% from their highs, global shares 21% and Australian shares 16%), share markets rallied into mid-August reversing half of their declines on the back of hopes the Fed would pivot towards an easier monetary stance and hopefully avoid a recession. Since mid-August though shares have fallen again and are now back to around their June lows.

Share markets back down

Source: Strategas, AMP

And, bond yields have pushed up again with US, UK, German 10-year yields rising to levels not seen in a decade.

What’s driving the renewed weakness

The plunge in shares back to their June lows mostly reflects the same concerns that drove the falls into June:

-

Inflation remains high or is still rising depending on the country. For example, US headline inflation is still 8.3%yoy and core inflation at 6.3%yoy in August is still under pressure from rising services inflation. Headline inflation is 8.9% in the UK, 9.1% in Europe, 9.9% in the UK and an estimated 7.2% in Australia.

-

Global central banks have become more hawkish noting that permanently high inflation will lead to lower living standards and the longer inflation stays high the greater the risk that inflation expectations move higher, making it harder to get down. As a result, they are committed to getting it back to target and have been flagging more rate hikes (eg with the dot plot of Fed interest rate forecasts around 1% higher than 3 months ago – next chart) and an implied tolerance for a recession in order to get it under control.

-

Increasingly hawkish central banks are bad for shares in the short term for two reasons. First higher interest rates and make shares less attractive from a valuation perspective. Second, a recession would weigh on company profits. Recession is now almost certain in Europe and about a 50% probability in the US. In Australia the probability of recession is now around 40% (if as we expect the cash rate peaks around 3%, but if it rises to 4.3% as predicted by the money market then recession is probable here). Historically deep bear markets in US and Australian shares have tended to be associated with a US recession.

Australian equity bear markets and US recessions

Source: ASX, Bloomberg, AMP

-

Fears of an escalation of the Ukraine war – after Russia’s troop mobilisation, “referenda” to incorporate occupied areas into Russia and a threat to use nuclear weapons. Ongoing tensions with China and the approaching November US mid-term elections are not helping.

-

A large fiscal stimulus in the UK has caused a surge in UK bond yields & plunge in the pound adding to fears of a crisis. While the new Government’s tax cuts and deregulation may have supply side merit the benefits of this tend to take years to become apparent and in the meantime the risk is that it adds to inflation and fears about runaway debt.

-

We are in a weak period of the year seasonally for shares – with September being the weakest month of the year on average for shares and October known for volatility. This can be magnified when the trend in shares is down.

-

As seen in the first half the year, tech stocks and particularly crypto currencies remain the biggest losers of monetary tightening, after being the biggest winners of easy money.

Shares are oversold and on technical support at their June lows so could bounce from here. But the risks are skewed to the downside in the short term. While investor confidence is very negative, we have yet to see the sort of spike in put/call option ratios or VIX that normally signals major market bottoms. The RBA is fortunately starting to sound a bit more balanced and aware of the way monetary policy impacts with a lag, but the danger is that the Fed and central banks have become locked into supersized hikes based on backward looking inflation and jobs data, and a loss of confidence in their ability to forecast inflation at a time when they should be giving more attention to monetary policy lags. This increases the risk of overtightening driving a deep recession with earnings downgrades driving another leg down in share prices (after the first leg down which was driven by rising bond yields). A decisive break below the June low for the US share market could open up another 10% leg down with a similar flow through to Australian shares.

It’s not all doom and gloom

However, there is some light at the end of the tunnel on a 12-month view:

-

Central banks determination to stop high inflation becoming entrenched is good news from a longer-term perspective as the 1970s experience tells us that the alternative would be bad for economies, jobs and investment markets.

-

Producer price inflation looks to have peaked in the US, UK, China and Japan.

-

This is consistent with our Pipeline Inflation Indicator which is continuing to trend down given falling price and cost components in business surveys, falling freight rates and lower commodity prices (outside of gas and coal).

AMP Pipeline Inflation Indicator

Source: Bloomberg, AMP

-

Some of the key components that initially drove higher inflation in the US are starting to slow with weakening growth in new market rents (which with a lag drives about 33% of the US CPI) and softening used car prices.

-

Consumer inflation expectations have fallen in the US and Australia, helped by aggressive central bank moves and falling petrol prices. US 5 year plus inflation expectations have fallen back to 2.8% which is well below the near 10% level seen in 1980. This should make it easier for central banks to get inflation back down without having to take interest rates to exorbitant levels.

-

Money supply growth has slowed from its 2020 surge, and this is likely to contribute to lower inflation ahead.

-

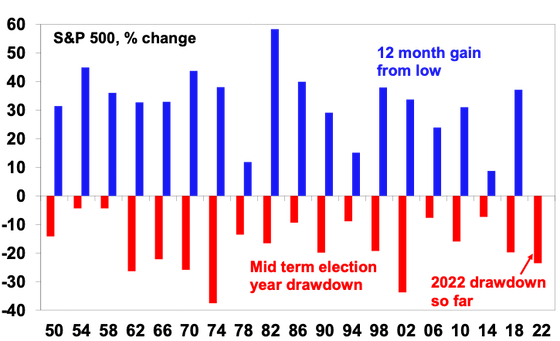

Post US mid-term election returns tend to be strong, just as mid-term election year drawbacks tend to be more severe – with an average top to bottom fall of 17% in US shares in mid-term election years followed by an average 33% gain one year from the low.

US mid-term election year share market drawdowns

Source: Strategas, Bloomberg, AMP

The bottom line is that while short-term inflation remains high, these considerations are consistent with the US having reached peak inflation and point to lower inflation ahead which should enable central banks to slow the pace of hiking by year end, in time to avoid a severe recession. If this applies in the US, then Australia should follow as its lagging the US by about six months with respect to inflation. (Although we expect the RBA to slow the pace of rate hikes well ahead of the US – given the greater sensitivity of the Australian household sector to higher rates than in the US and lower inflation pressures in Australia.) For this reason, while short term risks around shares remain high, we remain optimistic on shares on a 12-month horizon.

Key things for investors to bear in mind

Sharp share market falls are stressful for investors as no one likes to see their investments fall in value. And try as one may, it’s never easy to accurately predict economies and shares. So, at times like these it’s important to focus on basic investment principles. In particular, these things are worth keeping in mind:

-

share market pullbacks are healthy and normal – their volatility is the price we pay for the higher returns they provide over the long term;

-

it’s very hard to time market moves so the key is to stick to an appropriate long-term investment strategy;

-

selling shares after a fall locks in a loss;

-

share pullbacks provide opportunities for investors to buy them more cheaply;

-

shares invariably bottom with maximum bearishness;

-

Australian shares still offer an attractive income (or cash) flow relative to bank deposits; and

-

to avoid getting thrown off a long-term strategy – it’s best to turn down the noise around all the negative news flow.

Source: AMP Capital September 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.